DEF 14A: Definitive proxy statements

Published on July 9, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

July 9, 2024

Dear Dynatrace Stockholder:

I am pleased to invite you to attend the 2024 Annual Meeting of Stockholders of Dynatrace, Inc. to be held online on Friday, August 23, 2024 at 1:00 p.m. Eastern Time. You may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/DT2024, where you will be able to vote electronically and submit questions.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

Pursuant to the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to stockholders over the Internet, we are posting the proxy materials on the Internet and delivering a Notice of Internet Availability of Proxy Materials. On or about July 9, 2024, we will begin mailing this notice to our stockholders containing instructions on how to access online or request a printed copy of our Proxy Statement for the 2024 Annual Meeting of Stockholders and our Annual Report on Form 10-K for the year ended March 31, 2024.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet, by telephone, or virtually at the Annual Meeting or, if you requested printed copies of proxy materials, you also may vote by mailing a proxy card. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for being a Dynatrace stockholder. We look forward to seeing you at our Annual Meeting.

Sincerely,

Rick McConnell

Chief Executive Officer

| YOUR VOTE IS IMPORTANT | ||||||||||||||||||||

| In order to ensure your representation at the Annual Meeting, whether or not you plan to attend the Annual Meeting, please vote your shares as promptly as possible by following the instructions on your Notice or, if you requested printed copies of your proxy materials, by following the instructions on your proxy card. Your vote will help to ensure the presence of a quorum at the meeting and that your shares are represented at the Annual Meeting. If you hold your shares through a broker, your broker is not permitted to vote on your behalf for Proposal No. 1 (the election of directors), Proposal No. 3 (the advisory vote on the compensation of our named executive officers), or Proposal No. 4 (the proposed amendment to our Amended and Restated Certificate of Incorporation) unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet). For your vote to be counted, you will need to communicate your vote before the date of the Annual Meeting. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy, or voting your stock virtually at the Annual Meeting. | ||||||||||||||||||||

Dynatrace, Inc.

1601 Trapelo Road, Suite 116

Waltham, Massachusetts 02451

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that Dynatrace, Inc. will hold its 2024 Annual Meeting of Stockholders online on Friday, August 23, 2024 at 1:00 p.m. Eastern Time, for the following purposes:

•To elect two Class II directors, Jill Ward and Kirsten Wolberg, to hold office until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified, subject to their earlier resignation or removal;

•To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025;

•To conduct a non-binding, advisory vote to approve the compensation of our named executive officers;

•To approve an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers in certain circumstances as permitted pursuant to amendments to the Delaware General Corporation Law; and

•To transact any other business that properly comes before the Annual Meeting (including adjournments and postponements thereof).

Our Board of Directors recommends that you vote “FOR” the director nominees named in Proposal No. 1, “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm as described in Proposal No. 2, “FOR” the approval of, on a non-binding advisory basis, the compensation of our named executive officers as described in Proposal No. 3, and "FOR" approval of the amendment to our Amended and Restated Certificate of Incorporation as described in Proposal No. 4.

Stockholders of record at the close of business on June 28, 2024 (the "Record Date") or who hold a valid proxy for the Annual Meeting are entitled to notice of, and to attend, vote, and participate at the Annual Meeting, as set forth in this Proxy Statement. You may attend, vote, and participate at the Annual Meeting by visiting www.virtualshareholdermeeting.com/DT2024 and entering the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, on the proxy card, or in the instructions included with the proxy materials dated on or about July 9, 2024. Access to the webcast will begin at 12:45 p.m. Eastern Time on August 23, 2024. For instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the “About the Annual Meeting” section of this Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card. If you are a street name stockholder or beneficial owner of our common stock, please refer to the voting instructions or other materials received from your broker, bank, or other nominee to vote your shares.

By Order of the Board of Directors,

Nicole Fitzpatrick

Executive Vice President, Chief Legal Officer and Secretary

Waltham, Massachusetts

July 9, 2024

Important notice about the availability of proxy materials for the Annual Meeting. We encourage you to access and review all of the information contained in the proxy materials before voting. Our Proxy Statement, 2024 Annual Report to Stockholders, and other materials are available at https://ir.dynatrace.com/.

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

Table of Contents

Page

Cautionary Note Regarding Forward-Looking Statements

This Proxy Statement includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding management’s expectations related to industry trends and future financial and operational performance, and statements describing our strategy, outlook, plans, intentions, expectations or goals, including corporate governance, sustainability, and compensation strategies and the potential effects of the proposed amendment to our Charter (as defined in this Proxy Statement). These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this Proxy Statement that are not historical facts and statements identified by words such as "will," “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, our ability to maintain our revenue growth rates in future periods; market adoption of our product offerings; continued demand for, and spending on, our solutions; our ability to innovate and develop solutions that meet customer needs, including through Davis AI; the ability of our platform and solutions to effectively interoperate with customers’ IT infrastructures; our ability to acquire new customers and retain and expand our relationships with existing customers; our ability to expand our sales and marketing capabilities; our ability to compete; our ability to maintain successful relationships with partners; security breaches, other security incidents and any real or perceived errors, failures,

1

defects or vulnerabilities in our solutions; our ability to protect our intellectual property; our ability to hire and retain necessary qualified employees to grow our business and expand our operations; our ability to successfully complete acquisitions and to integrate newly acquired businesses and offerings; the effect on our business of the macroeconomic environment, associated global economic conditions and geopolitical disruption; the plans, intentions, or expectations disclosed in our forward-looking statements may not be achieved or do not have their intended effects; and other risks set forth under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and our other filings with the Securities and Exchange Commission (the “SEC”). We assume no obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

Non-GAAP Measures and Key Metrics

Our executives are in certain ways measured and rewarded based on the company's or their personal achievement of certain non-GAAP financial measures, including non-GAAP operating income, and certain operational metrics, such as Annual Recurring Revenue (“ARR”). For additional information and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, please see Appendix A of this Proxy Statement.

Non-GAAP Operating Income or NGOI is defined as GAAP operating income adjusted to exclude share-based compensation, employer payroll taxes on employee stock transactions, amortization of intangibles, and certain restructuring and other gains and losses.

Annual Recurring Revenue or ARR is defined as the daily revenue of all subscription agreements that are actively generating revenue as of the last day of the reporting period multiplied by 365. We exclude from our calculation of total Annual Recurring Revenue any revenues derived from month-to-month agreements and/or product usage overage billings.

Dynatrace presents constant currency amounts for Annual Recurring Revenue to provide a framework for assessing how our underlying business performed excluding the effect of foreign currency rate fluctuations. To present this information, current and comparative prior period results for entities reporting in currencies other than U.S. dollars are converted into U.S. dollars using the average exchange rates from the comparative period rather than the actual exchange rates in effect during the respective periods. All growth comparisons relate to the corresponding period in the last fiscal year.

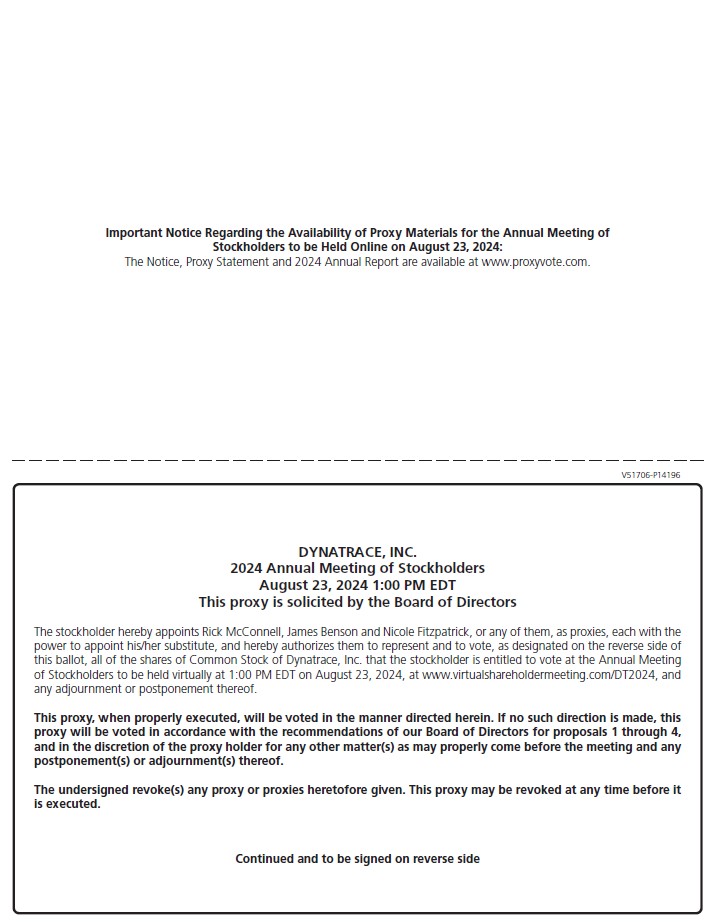

Availability of Certain Documents

This Proxy Statement and our 2024 Annual Report to Stockholders are available for viewing, printing, and downloading at www.proxyvote.com.

Unless specifically stated in this Proxy Statement, information (such as our Global Impact Report) contained on, or that can be accessed through, our websites and any other websites listed in this Proxy Statement are not incorporated by reference into this Proxy Statement and should not be considered to be part of this Proxy Statement, and inclusions of our website addresses and other website addresses in this Proxy Statement are inactive textual references only.

A copy of our Annual Report on Form 10-K for the fiscal year ended March 31, 2024, as filed with the SEC, except for exhibits, will be furnished without charge to any stockholder upon written request to Dynatrace, Inc., 1601 Trapelo Road, Suite 116, Waltham, Massachusetts 02451, Attention: Secretary or by e-mail to ir@dynatrace.com. This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 are also available on the SEC’s website at www.sec.gov and on our website at https://ir.dynatrace.com/.

The Dynatrace logo and all Dynatrace product or service names and logos are trademarks or registered trademarks of Dynatrace LLC in the United States and other countries. The Dynatrace® platform is subject to patents owned by Dynatrace LLC issued and pending in the United States and other countries. Third party trademarks and trade names referenced in this Proxy Statement are the property of their respective owners.

2

ABOUT THE ANNUAL MEETING

General Information

This Proxy Statement contains information about the 2024 Annual Meeting of Stockholders of Dynatrace, Inc., which will be held online on August 23, 2024 at 1:00 p.m. Eastern Time.

If you are a stockholder of record as of the close of business on June 28, 2024, you may attend the meeting virtually via the Internet at www.virtualshareholdermeeting.com/DT2024, where you will be able to vote electronically and submit questions. We encourage participants to access the meeting prior to the start time. Online check-in will begin 15 minutes prior to the start of the Annual Meeting, at 12:45 p.m. Eastern Time, and participants should allow ample time for check-in procedures.

The Board of Directors of Dynatrace, Inc. (the "Board") is using this Proxy Statement to solicit proxies for use at the Annual Meeting.

In this Proxy Statement, the terms “Dynatrace,” the “company," “we,” “us,” and “our” refer to Dynatrace, Inc. The mailing address of our principal executive offices is Dynatrace, Inc., 1601 Trapelo Road, Suite 116, Waltham, Massachusetts 02451. Our fiscal year begins on April 1 and ends on March 31.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our Board with respect to each of the matters set forth in the accompanying Notice of 2024 Annual Meeting of Stockholders. You may revoke your proxy at any time before it is exercised at the meeting by giving our Secretary written notice to that effect.

When are this Proxy Statement and the accompanying materials scheduled to be sent to stockholders?

We have elected to provide access to our proxy materials to our stockholders via the Internet. Accordingly, on or about July 9, 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”). Our proxy materials, including the Notice of 2024 Annual Meeting of Stockholders, this Proxy Statement, and the accompanying proxy card or, for shares held in street name (i.e., held for your account by a broker, bank, or other nominee), a voting instruction form, and the 2024 Annual Report for the year ended March 31, 2024 (the “2024 Annual Report”), will be mailed or made available to stockholders on the Internet on or about the same date.

Why did I receive the Notice instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, for most stockholders, we are providing access to our proxy materials over the Internet rather than printing and mailing our proxy materials. We believe following this process will expedite the receipt of such materials and will help lower our costs and reduce the environmental impact of our annual meeting materials. Therefore, the Notice will be mailed to holders of record and beneficial owners of our common stock starting on or about July 9, 2024. The Notice provides instructions as to how stockholders may access and review our proxy materials, including the Notice of 2024 Annual Meeting of Stockholders, this Proxy Statement, the proxy card, and our 2024 Annual Report, on the website referred to in the Notice or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to them by mail. The Notice also provides voting instructions. In addition, stockholders of record may request to receive the proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future stockholder meetings. Please note that while our proxy materials are available at the website referenced in the Notice, and our Notice of 2024 Annual Meeting of Stockholders, this Proxy Statement, and our 2024 Annual Report are available on our website, www.dynatrace.com, no other information contained on either website is incorporated by reference in or considered to be a part of this Proxy Statement.

Who is soliciting my vote?

Our Board is soliciting your vote for the Annual Meeting.

When is the Record Date for the Annual Meeting?

The Record Date for determination of stockholders entitled to vote at the Annual Meeting was the close of business on June 28, 2024.

3

How many votes can be cast by all stockholders?

There were 298,215,657 shares of our common stock, par value $0.001 per share, outstanding on June 28, 2024, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder of record is entitled to one vote for each share of our common stock held by such stockholder. No shares of preferred stock were outstanding as of June 28, 2024.

How do I attend the Annual Meeting virtually?

This year’s Annual Meeting will be held virtually. To attend and participate in the Annual Meeting, stockholders will need to access the live webcast of the meeting. You are entitled to attend and participate if you were a stockholder as of the close of business on June 28, 2024 or hold a valid proxy for the meeting. Individuals who log in as a guest may attend the Annual Meeting, but are not entitled to vote or submit questions. Attendance at the Annual Meeting is subject to capacity limits set by the virtual meeting platform provider.

Stockholders of Record. Stockholders of record will need to visit www.virtualshareholdermeeting.com/DT2024 and enter the 16-digit control number provided in the Notice, on the proxy card, or in the instructions included with the printed proxy materials.

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name” (i.e., a “street name stockholder”) and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. If you are a street name stockholder and your voting instruction form or Notice indicates that you may vote those shares through www.proxyvote.com, you may attend and participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/DT2024 and entering the 16-digit control number indicated on your voting instruction form or Notice. Otherwise, street name stockholders who hold their shares in street name should contact their broker, bank or other nominee (well in advance of the Annual Meeting) to obtain a legal proxy in order to be able to attend and participate in the Annual Meeting.

If you are a stockholder and wish to submit a question during the Annual Meeting, you may log into, and submit a question on, the virtual meeting platform by following the instructions included there. During the formal portion of the meeting, all questions presented should relate directly to the proposal under discussion. Questions from multiple stockholders on the same topic or that are otherwise related to a particular topic may be grouped, summarized, and answered together. If questions submitted are irrelevant to the business of the Annual Meeting or are out of order or not otherwise suitable for the conduct of the Annual Meeting, as determined by the Chair of the Board or Secretary in their reasonable judgment, we may choose to not address them. If there are any matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question posed was not otherwise answered, such matters may be raised separately after the Annual Meeting.

Our Annual Meeting will be governed by the Annual Meeting’s Rules of Conduct, which will address the ability of stockholders to ask questions during the meeting and rules for how questions will be recognized and addressed. The Annual Meeting’s Rules of Conduct will be available on www.virtualshareholdermeeting.com/DT2024 prior to the Annual Meeting. We do not have procedures in place for posting appropriate questions received during the meeting on our website.

What if I have technical issues during the Annual Meeting?

Participants should give themselves plenty of time to log in and ensure they have a strong Internet connection, and they can hear streaming audio prior to the start of the meeting.

Approximately 15 minutes prior to the start of and through the conclusion of the Annual Meeting, a support team will be ready to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter technical difficulties with the virtual meeting platform on the meeting day, please call the technical support number that will be posted on the meeting website.

Additional information regarding matters addressing technical and logistical issues, including technical support during the Annual Meeting, will be available at www.virtualshareholdermeeting.com/DT2024.

4

How do I vote?

Stockholders of Record. If shares of our common stock are registered directly in your name with Computershare, our transfer agent, you are considered the “stockholder of record” with respect to those shares. As the stockholder of record, you may vote by any of the methods listed below:

Virtually In Person

You may attend the Annual Meeting virtually via the Internet at www.virtualshareholdermeeting.com/DT2024 and you may vote during the meeting. Access to the webcast will begin at 12:45 p.m. Eastern Time on August 23, 2024, and you should allow ample time for check-in procedures. In order to be able to attend the Annual Meeting, you will need the 16-digit control number provided in the Notice, on the proxy card, or in the instructions included with the proxy materials dated on or about July 9, 2024.

By Internet or by Phone Before the Annual Meeting

You may vote by proxy by completing an electronic proxy card over the Internet, or by telephone by following the instructions provided in the Notice or proxy card until 11:59 p.m. Eastern Time on August 22, 2024.

By Mail

If you requested printed copies of the proxy materials, you may vote by proxy by mailing your proxy card as described in the proxy materials. In order to be counted, proxies submitted by mail must be received before the start of the Annual Meeting.

Street Name Stockholders. As stated above, if shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name” (i.e., a “street name stockholder”) and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank, or other nominee as to how to vote your shares. Please follow the instructions from your broker, bank, or other nominee to vote. Street name stockholders may not vote virtually in person at the Annual Meeting unless they receive a legal proxy from their respective brokers, banks, or other nominees giving them the right to vote virtually in person at the Annual Meeting. If you request a printed copy of our proxy materials by mail, your broker, bank, or other nominee will provide a voting instruction form for you to use.

What is the effect of giving a proxy?

If you are a stockholder of record and complete and submit your proxy before the Annual Meeting, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy without giving voting instructions, your shares will be voted in the manner recommended by our Board on all matters presented in this Proxy Statement. In the event we receive proxies for disqualified or withdrawn director nominees, such votes for disqualified or withdrawn nominees in the proxies will be treated as abstentions.

If any other matters are properly presented for consideration at the Annual Meeting or any postponements or adjournments thereof, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in your proxy and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting. If the Annual Meeting is adjourned, continued, or postponed, the proxy holders can vote your shares on the new Annual Meeting date as well, unless you revoke your proxy instructions as described above.

You may also authorize another person or persons to act for you as a proxy in a writing, signed by you or your authorized representative, specifying the details of those proxies’ authority. The original writing must be given to each of the named proxies, although it may be sent to them by electronic transmission if, from that transmission, it can be determined that the transmission was authorized by you.

How do I revoke my proxy?

If you are a stockholder of record, you may revoke your proxy by (1) following the instructions on the Notice and entering a new proxy vote by mail that we receive before the start of the Annual Meeting or over the Internet or by phone by the cutoff time of 11:59 p.m. Eastern Time on August 22, 2024; (2) attending and voting virtually at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself revoke a proxy); or (3) filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with our Secretary. Any written notice of revocation or subsequent proxy card must be received

5

by our Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Secretary or sent to our principal executive offices at Dynatrace, Inc., 1601 Trapelo Road, Suite 116, Waltham, Massachusetts 02451, Attention: Secretary.

If a broker, bank, or other nominee holds your shares, you must contact such broker, bank, or nominee in order to find out how to change your vote.

How is a quorum reached?

A majority of the shares entitled to vote, present in person or by remote communication, or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. As of the Record Date, there were 298,215,657 shares of our common stock outstanding. Therefore, a quorum will be present if 149,107,829 shares of our common stock are present, virtually in person or by proxy, representing a majority of all issued and outstanding shares of common stock entitled to vote as of the Record Date.

Shares that are voted “abstain” or “withheld” and broker “non-votes” are counted as present for purposes of determining whether a quorum is present at the Annual Meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

What vote is required to adopt the proposals?

| Proposal | Vote Required | Impact of Withholds or Abstentions | Impact of Broker Non-Votes | Unmarked Proxy Cards | ||||||||||

| 1 - Election of Class II directors | Plurality of the votes properly cast. This means the nominees receiving the most "FOR" votes will be elected | No effect | No effect | Voted "FOR" | ||||||||||

| 2 - Ratification of the appointment of Ernst & Young LLP as the company's independent registered accounting firm for fiscal 2025 | Majority of the votes properly cast "FOR" and "AGAINST" | No effect | No effect; not anticipated as brokers have discretionary voting authority for this proposal | Voted "FOR" | ||||||||||

3 - Non-binding, advisory vote to approve the compensation of our named executive officers (1)

|

Majority of the votes properly cast "FOR" and "AGAINST" | No effect | No effect | Voted "FOR" | ||||||||||

| 4 - Approval of an amendment to our Amended and Restated Certificate of Incorporation related to officer exculpation | Majority of the outstanding shares of capital stock entitled to vote | Equivalent to an "AGAINST" vote | Equivalent to an "AGAINST" vote | Voted "FOR" | ||||||||||

(1) As Proposal No. 3 is an advisory vote, the result will not be binding on us, our Board or our Compensation Committee of the Board (the "Compensation Committee"). However, the Board values input from stockholders, and the Compensation Committee will consider the outcome of the vote when making future decisions regarding the compensation of our named executive officers.

What are broker "non-votes"?

Your broker or nominee may have the discretion to vote those shares with respect to certain matters if they have not received instructions from you. Under the rules of the New York Stock Exchange (“NYSE”), brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under NYSE rules but not with respect to “non-routine” matters. Proposal No. 2 is considered to be a “routine” matter under NYSE rules and thus if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal No. 2.

A broker non-vote occurs when a broker, bank, or other agent has not received voting instructions from the beneficial owner of the shares and the broker, bank, or other agent cannot vote the shares because the matter is considered “non-routine” under NYSE rules. Proposals No. 1, 3, and 4 are considered to be “non-routine” under NYSE rules such that your broker, bank, or other agent may not vote your shares on those proposals in the absence of your voting instructions.

6

Who pays the cost for soliciting proxies?

We are making this solicitation and will pay the entire cost of preparing and distributing the Notice and our proxy materials and soliciting votes. If you choose to access the proxy materials or vote over the Internet, you are responsible for any Internet access charges that you may incur. Our officers and employees may, without compensation other than their regular compensation, solicit proxies through further mailings, personal conversations, e-mails, or otherwise. We have hired Broadridge Financial Solutions, Inc. to assist us in the distribution of proxy materials. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning, and tabulating the proxies. We have also retained Innisfree M&A Incorporated to provide consulting and analytic services in connection with the Annual Meeting for a fee of $20,000 plus reasonably incurred out of pocket fees and expenses.

How can I know the voting results?

We plan to announce preliminary voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Annual Meeting.

PROPOSAL NO. 1

ELECTION OF CLASS II DIRECTORS

Our Board currently consists of eight members, seven of whom are non-employee, independent directors. In accordance with the terms of our certificate of incorporation and bylaws, our Board is divided into three classes, Class I, Class II, and Class III, with members of each class serving staggered three-year terms. Directors are expected to be elected to hold office for such three-year term or until the election and qualification of their successors in office, subject to their earlier resignation or removal.

The members of our Class I, Class II and Class III directors are the following individuals:

| Name | Class | Expiration of Term | ||||||

| Rick McConnell | I | 2026 | ||||||

Michael Caponeü

|

I | 2026 | ||||||

Stephen Lifshatzü

|

I | 2026 | ||||||

Jill Wardü

|

II | 2024 | ||||||

Kirsten Wolbergü

|

II | 2024 | ||||||

Amol Kulkarniü

|

III | 2025 | ||||||

Steve Rowlandü

|

III | 2025 | ||||||

Kenneth “Chip” Virnigü

|

III | (1) | ||||||

ü = independent

(1) On June 20, 2024, Chip Virnig notified the Board of his resignation effective as of July 31, 2024. The Board thanks Chip for his service and contributions as a director over the last nine years.

|

What are you voting on?

At the meeting, you’re being asked to re-elect our two Class II directors - Jill Ward and Kirsten Wolberg - for a term to expire at the annual meeting of stockholders to be held in 2027.

| ||

| THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH DIRECTOR NOMINEE | ||

Upon the expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Jill Ward and Kirsten Wolberg have each indicated a willingness to continue to serve as directors, if elected. If any of the nominees become unable or unwilling to serve, however, your proxy may be voted for a substitute nominee selected by our Board.

The election of directors requires a plurality of the votes properly cast "FOR" each nominee. Votes to "withhold" and broker non-votes will have no effect on the election of the nominees.

7

Nominees for Election as Class II Directors

The following are our two directors who are nominated for election at the Annual Meeting and sets forth their principal occupation and business experience during the last five years and their ages as of June 28, 2024.

| Jill Ward | |||||

Age: 64

Director Since: 2019

Board Chair Since: 2021

Independent

Committees:

•Audit

•Nominating and Corporate Governance (Chair)

|

Jill Ward has served on the board of directors of HubSpot (NYSE: HUBS), a provider of a customer management platform for businesses, since October 2017 and on the board of directors of Informatica (NYSE: INFA), an enterprise cloud data management company, since June 2021. Jill served on the board of directors of Carbon Black, Inc. (formerly NASDAQ: CBLK), a cybersecurity company, from December 2018 until its acquisition by VMware, Inc. in October 2019. Jill served as an operating partner of Lead Edge Capital, a growth equity investment firm, from October 2018 to February 2020. Previously, she served as President and Chief Operating Officer of Fleetmatics Group PLC (formerly NYSE: FLTX), a provider of software-as-a-service for fleet management, from April 2015 until its acquisition by Verizon Communications in November 2016. Prior to Fleetmatics, Jill held executive leadership roles at Intuit Inc. (NASDAQ: INTU), most recently serving as Senior Vice President and General Manager. Jill’s experience also includes leadership roles at Telespectrum, Fidelity Investments, and strategy firm Bain & Company. Jill holds an M.B.A. from the Tuck School of Business at Dartmouth College and a B.A. from Wellesley College. Our Board believes that Jill’s board and business experience and her overall knowledge of our industry qualify her to serve on our Board.

|

||||

| Kirsten O. Wolberg | |||||

Age: 56

Director Since: 2021

Independent

Committees:

•Cybersecurity (Chair)

•Nominating and Corporate Governance

|

Kirsten O. Wolberg has served on the board of directors of lender Sallie Mae, formally SLM Corporation (NASDAQ: SLM), since November 2016 and enterprise technology company CalAmp Corp. (formerly NASDAQ: CAMP) since August 2020. Kirsten also serves on the board of directors of other private and non-profit organizations. Kirsten served as the Chief Technology and Operations Officer for DocuSign, Inc. (NASDAQ: DOCU), a provider of e-signature products and other technology, from November 2017 to February 2021. From January 2012 to October 2017, Kirsten was a Vice President at PayPal, Inc., a subsidiary of PayPal Holdings, Inc. (NASDAQ: PYPL), a technology platform, where she served in various executive roles including as Vice President, Technology from 2012 to 2015. Prior to that, Kirsten was Chief Information Officer for Salesforce (NYSE: CRM), a provider of customer relationship management software and solutions, from May 2008 to September 2011. Kirsten holds an M.B.A. from the J.L. Kellogg Graduate School of Management at Northwestern University and a B.S. in Business Administration from the University of Southern California. Our Board believes that Kirsten’s board, cyber and enterprise technology experience and her overall knowledge of the SaaS software industry qualify her to serve on our Board.

|

||||

8

Directors Continuing in Office

The following are our five directors continuing in office and sets forth their principal occupation and business experience during the last five years and their ages as of June 28, 2024.

Class I Directors (Term Expires at the 2026 Annual Meeting)

| Rick McConnell | |||||

Age: 58

Director Since: 2021

Not Independent

Committees: None

|

Rick McConnell has served as our Chief Executive Officer and a director since December 2021. He has over 30 years of experience scaling multi-billion-dollar organizations, developing winning cultures, building broad-based product portfolios and establishing go-to-market strategies and execution plans to drive category leadership. Rick worked at Akamai Technologies (NASDAQ: AKAM), a cloud, security, and content delivery company, from November 2011 to December 2021, where he held multiple positions, including President and General Manager of the Security Technology Group, President and General Manager of Akamai’s Web Division, and President, Products and Development. From 2004 to 2011, he worked at Cisco Systems Inc. (NASDAQ: CSCO), a technology company, in various senior executive roles. He joined Cisco when the company acquired Latitude Communications, a provider of voice and Internet conferencing solutions, where he was President and Chief Executive Officer. Rick holds a B.A. in Quantitative Economics and an M.B.A., both from Stanford University. Our Board believes that based on Rick’s knowledge of our company and our business, and his service as our Chief Executive Officer, Rick is qualified to serve on our Board.

|

||||

| Michael Capone | |||||

Age: 57

Director Since: 2019

Independent

Committees:

•Compensation (Chair)

•Cybersecurity

|

Michael Capone has served as the Chief Executive Officer of Qlik Technologies, Inc., a provider of data analytics and integration which is owned by certain investment funds advised by Thoma Bravo, since January 2018. Prior to that, Mike served as the Chief Operating Officer of Medidata Solutions, Inc. (formerly NASDAQ: MDSO), a provider of cloud-based solutions for clinical research in life sciences, from October 2014 to December 2017. Prior to joining Medidata, Mike worked in various executive positions at Automatic Data Processing, Inc., or ADP (NASDAQ: ADP), a global technology company providing human capital management solutions, serving as Corporate Vice President of Product Development and Chief Information Officer from July 2008 to September 2014, and Senior Vice President and General Manager of ADP’s Global HR/Payroll Outsourcing Business from July 2005 to June 2008. He also served on the board of directors of Ellie Mae, a provider of technology solutions for the mortgage industry which was previously owned by certain investment funds advised by Thoma Bravo, between May 2019 and September 2020. Mike holds a B.S. in Computer Science from Dickinson College and an M.B.A. in Finance from Pace University. Our Board believes that Mike’s board and business experience and his overall knowledge of our industry qualify him to serve on our Board.

|

||||

9

| Stephen Lifshatz | |||||

Age: 65

Director Since: 2019

Independent

Committees:

•Audit (Chair)

•Compensation

|

Stephen Lifshatz has served as Executive Vice President and Chief Financial Officer of CDK Global, a software provider for the automotive industry, since February 2023. Steve served as the Chief Financial Officer for Lytx, a private video telematics company, from May 2018 through September 2021. Prior to joining Lytx, from January 2017 through May 2018, Steve was engaged as an independent consultant by several private equity firms to assist in the development and expansion of certain of their portfolio companies. Prior to that, Steve served as Chief Financial Officer of Fleetmatics Group PLC (formerly NYSE: FLTX), a provider of software-as-a-service for fleet management, from December 2010 to December 2016. Steve has also served as Chief Financial Officer of four additional private and public companies during his career. Steve served on the board of directors of Amicas, Inc. (formerly NASDAQ: AMCS), a provider of imaging IT solutions, from June 2007 until June 2010, as well as on the board or advisory board of several private companies. Steve holds a B.S. in Accounting and Marketing from Skidmore College. Our Board believes that Steve’s board and business experience and his overall knowledge of our industry qualify him to serve on our Board.

|

||||

Class III Directors (Term Expires at the 2025 Annual Meeting)

Age: 54

Director Since: 2023

Independent

Committees:

• Compensation

• Nominating and Corporate Governance

|

Amol Kulkarni has served as a Senior Advisor to Permira, a private equity firm, since September 2023, and he is also a strategic advisor/advisory board member to other privately held technology companies. Until August 2023, Amol served as Chief Product and Engineering Officer of CrowdStrike (NASDAQ: CRWD), a cybersecurity company, and prior to that as the company’s Senior Vice President of Engineering and Products. Before joining CrowdStrike in 2014, Amol held various product and software leadership roles for 14 years at Microsoft (NASDAQ: MSFT), a global technology company. He currently serves on the boards of directors of JumpCloud, a privately held company focused on managing and securing employee access to organizations’ systems, and xfactor.io, a privately held company that operates an AI-powered revenue platform. He received a Bachelor of Engineering degree from the University of Poona, a Master of Technology degree in Energy Systems Engineering from the Indian Institute of Technology, Bombay, and a Ph.D. in Electrical Engineering from the University of Washington. Our Board believes that Amol’s technology and business experience and his overall knowledge of our industry qualify him to serve on our Board.

|

||||

10

| Steve Rowland | |||||

Age: 56

Director Since: 2021

Independent

Committees:

•Audit

|

Steve Rowland has served as President of Klaviyo (NYSE: KVYO), a company that powers digital relationships, since July 2023. Steve served as Chief Revenue Officer of Okta, Inc. (NASDAQ: OKTA), an independent identity provider, from March 2021 to March 2023 and was a full time advisor to Okta from March 2023 to June 2023. Steve has also been Executive Advisor and Limited Partner at Forté Ventures LP, a venture capital firm, since May 2019. Prior to these roles, from August 2019 to March 2021, he served as Vice President, Americas at Splunk Inc. (formerly NASDAQ: SPLK), a provider of cybersecurity and observability services. From October 2015 to August 2019, he served as President at DataStax, Inc., a technology company. He has also held executive leadership roles at other technology companies including Apigee Corp., Blue Coat Systems LLC and BMC Software Inc. Steve holds a B.S. in Engineering from Texas A&M University. Our Board believes that Steve’s leadership and go-to-market experience and his overall knowledge of our industry qualify him to serve on our Board.

|

||||

Non-Continuing Director

On June 20, 2024, Chip Virnig notified the Board of his resignation effective as of July 31, 2024.

| Kenneth “Chip” Virnig | |||||

Age: 40

Director Since: 2015

Independent

Committees:

•Cybersecurity

|

Kenneth “Chip” Virnig has served as Partner at Thoma Bravo since September 2018 and as Principal at Thoma Bravo from July 2015 to September 2018. Chip joined Thoma Bravo in 2008 and served as Vice President prior to his promotion to Principal. Prior to joining Thoma Bravo, Chip worked as an analyst in the investment banking group at Merrill Lynch & Co. from July 2006 to July 2008. He previously served on the board of directors of SailPoint Technologies Holdings, Inc. (formerly NYSE: SAIL) until March 2019 and currently serves as a director of several software and technology service companies in which certain investment funds advised by Thoma Bravo hold an investment. Chip received a B.A. in Business Economics, Commerce, Organizations and Entrepreneurship from Brown University. Our Board believes that Chip’s board and industry experience and his overall knowledge of our business have qualified him to serve on our Board.

|

||||

11

Board Experience and Skills Matrix

The Board believes that having a mix of directors with complementary backgrounds is necessary to meet its oversight responsibilities. We believe the Board collectively possesses the experience and skills needed for Dynatrace’s business and strategy.

The matrix below summarizes some of the top areas of experience and skills indicated by our seven directors who are nominees or otherwise continuing in office as of the Annual Meeting. This matrix is a summary and does not reflect every experience or skill that a director may possess.

| Experience or Skill | Description | Number of Directors | |||||||||

|

Public Company Board | Experience as a director of another public company | 3 | ||||||||

|

CEO/Senior Executive | Experience as a CEO or senior executive at a public company or large organization | 7 | ||||||||

|

SaaS Scale | Experience building or growing successful SaaS companies, reaching scale and maturity | 7 | ||||||||

|

Product Management | Experience in product strategy, design or development, multi-product management, and/or responsibility for product roadmap |

3 | ||||||||

|

Technology | A significant background in leading technology businesses and/or experience leading software development, SaaS, cloud, platform, infrastructure, data, or AI |

4 | ||||||||

|

Cybersecurity, Information Security, or Privacy | Significant experience assessing, overseeing, or managing cybersecurity, information security, or privacy strategies, risks, or programs | 4 | ||||||||

|

Go-to-Market | Experience in sales, digital marketing, branding, channels, or partners | 3 | ||||||||

|

Global | Leadership of global operations or global expansion | 6 | ||||||||

|

Financial | Experience in financial strategy, accounting, reporting, financing, P&L ownership, mergers and acquisitions, or management |

4 | ||||||||

|

Diversity | Diversity in gender identity or expression, race or ethnicity, or LGBTQ+ | 3 | ||||||||

12

Diversity

The Board believes that diversity in its membership is important to serving the long-term interests of stockholders. Our Corporate Governance Guidelines state that in identifying and evaluating candidates, the Nominating and Corporate Governance Committee of the Board (the "Nominating and Corporate Governance Committee") considers diversity (including diversity of gender identity or expression, race, ethnicity, age, and sexual orientation) and any other factors the Nominating and Corporate Governance Committee considers appropriate. The Board has demonstrated its commitment to diversity through three of its four most recent director appointments. Most recently, in September 2023, Amol Kulkarni, who identifies as a racially and ethnically diverse person, was appointed to the Board as an independent director.

Two of our seven directors who are nominees or otherwise continuing in office as of the Annual Meeting (approximately 29%) self-identify as a woman and both have Board leadership positions - the Chair of our Board and the Chair of the Nominating and Corporate Governance Committee, Jill Ward, and the Chair of our Cybersecurity Committee of the Board (the "Cybersecurity Committee"), Kirsten Wolberg. Prior to a director resignation in May 2023, women comprised 33 1/3% of our Board. The Board plans to add another gender diverse director by the time of next year’s annual meeting of stockholders to be held in 2025.

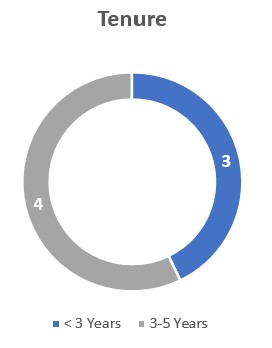

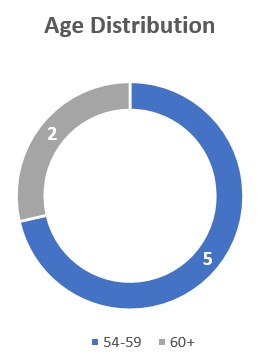

Tenure and Age

The following graphs set forth the tenure and age distributions as of June 28, 2024 of our seven directors who are nominees or otherwise continuing in office as of the Annual Meeting:

The average tenure of these directors was approximately 3.4 years and their average age was 59 years old.

Among other factors, the Board reviews and considers director tenure and age as factors in assessing its ongoing needs. The Board has not adopted term limits or a mandatory retirement age for individual directors.

Other Relationships

There are no family relationships between or among any of our directors or executive officers. The principal occupation and employment during the past five years of each of our directors was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary, or other affiliate of Dynatrace.

Chip Virnig was previously nominated for election to our Board by one of the Thoma Bravo Funds, as provided under our Charter. For more information, see the section “Corporate Governance – Overview – Director Nomination Rights” below. There is no other arrangement or understanding between any of our directors and any other person or persons pursuant to which he or she is to be selected as a director.

13

CORPORATE GOVERNANCE

Overview

Our company’s business and affairs are managed by or under the direction of the Board, acting on behalf of stockholders. The Board has delegated authority and responsibility to our company’s officers to manage the company’s day-to-day affairs. The Board has an oversight role and does not perform or duplicate the tasks of the CEO or senior management.

Our Board currently consists of eight members, seven of whom are non-employee, independent directors. As of the Annual Meeting, the Board will consist of seven members, six of whom are non-employee, independent directors. In accordance with the terms of our certificate of incorporation and bylaws, our Board is divided into three classes, Class I, Class II, and Class III, with members of each class serving staggered three-year terms. Depending on the Board’s assessment of our company’s needs and other factors, the Board reserves the right at any time to increase or decrease its size, subject to any applicable provisions in our company’s Charter.

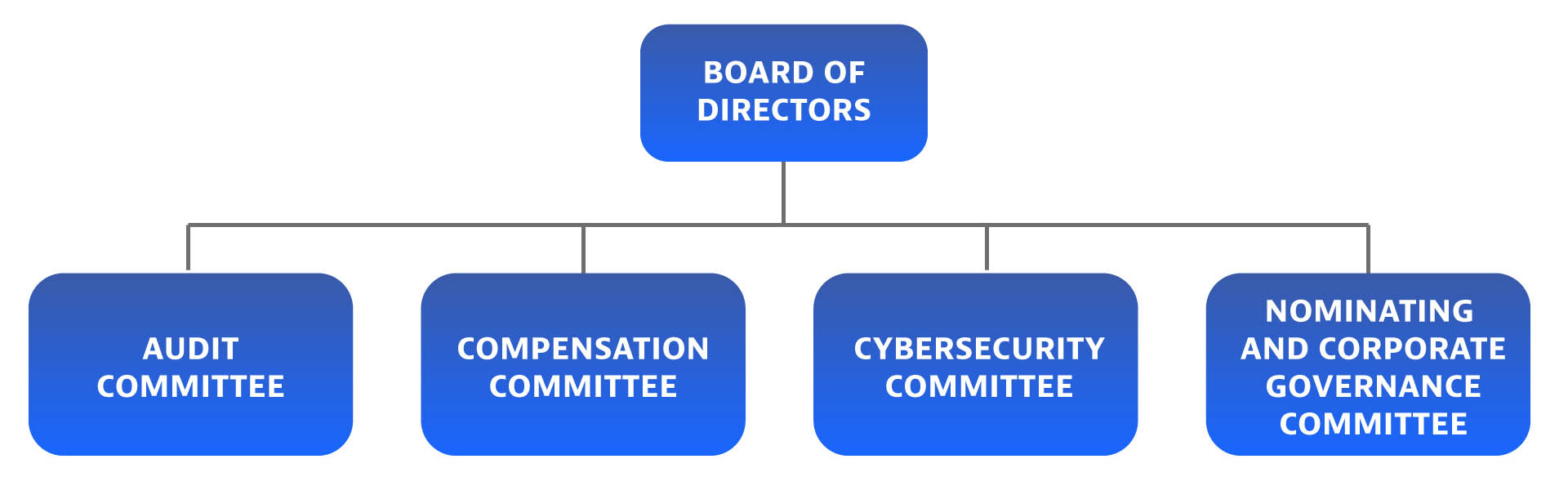

Board Structure

Our Board has four standing committees. The composition and responsibilities of each committee is discussed later in this “Corporate Governance” section. Each committee member is independent.

A copy of the charter for each committee is posted on the governance section of our website, https://ir.dynatrace.com/corporate-governance/governance-documents. In addition, we have adopted Corporate Governance Guidelines that formalize certain fundamental board policies and practices. Both of these documents are posted on the governance section of our website, https://ir.dynatrace.com/corporate-governance/governance-documents.

Independence

Seven of our eight directors are independent. As of the Annual Meeting, six of our seven directors will be independent. Our Corporate Governance Guidelines provide that at least a majority of the Board shall be independent.

At least annually, the Board evaluates all relationships between our company and each director for the purposes of determining whether a material relationship exists that might represent a potential conflict of interest or otherwise interfere with the director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, the Board then makes an annual determination of whether each director is independent within the meaning of applicable independence standards of the NYSE, the SEC, and our applicable committees.

In June 2024, the Board conducted its annual review of the independence of each director. Based on information submitted by each director concerning his or her background, employment, and affiliations, and upon the recommendation of the Nominating and Corporate Governance Committee, the Board determined that each of our directors (other than our CEO, Rick McConnell) has no material relationship with our company that might represent a potential conflict of interest or otherwise interfere with the director’s ability to satisfy his or her responsibilities as an independent director and that each of these directors is “independent” as that term is defined under NYSE listing standards. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our company and other facts and circumstances that our Board deemed relevant in determining their independence and eligibility to serve on the committees of our Board, including, without limitation, the transactions involving them described in the section of this Proxy Statement entitled “Certain Relationships and Related Party Transactions.”

14

The Board also determined that each member of each of the committees of the Board is independent within the meaning of applicable independence standards of the NYSE, the SEC, and applicable committees' standards, including Rule 10a-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Board Leadership Structure

Jill Ward has served as Chair of the Board since 2021. Jill is an independent, non-management director. The Chair is primarily responsible for overseeing the operations and affairs of the Board and acting as a liaison between management and the Board. Currently, the role of Chair is separated from the role of Chief Executive Officer. We believe that separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chair to lead the Board in its fundamental role of providing advice to, and independent oversight of, management. Our Board recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chair, particularly as the Board’s oversight responsibilities continue to grow. While our bylaws and our Corporate Governance Guidelines do not require that our Chair and Chief Executive Officer positions be separate, our Board believes that having separate positions is the appropriate leadership structure for us at this time and reflects our commitment to strong corporate governance. If the Chair and Chief Executive Officer were to be the same person, the Board may consider appointment of a Lead Independent Director.

Our non-employee, independent directors meet at regularly scheduled executive sessions without management participation. Jill Ward, as Chair of the Board, presides at those sessions.

Director Nomination Rights

Our Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board, and recommending such persons to be nominated for election as directors, except where we are legally required by contract, law, or otherwise to provide third parties with the right to nominate. For additional information, please see the section below titled “Our Director Nomination Process”.

The Thoma Bravo Funds (as defined in our Charter) previously made significant equity investments in our company and have reduced their ownership since our initial public offering (“IPO”) in 2019. Under our Charter, one of the Thoma Bravo Funds has certain director nomination rights based on the Thoma Bravo Funds' and their affiliates' beneficial ownership of our outstanding common stock. However, as of June 28, 2024, the Thoma Bravo Funds and their affiliates beneficially owned less than 5% of our common stock and are not entitled to nominate any of our directors. As disclosed earlier in this Proxy Statement, Chip Virnig is resigning from the Board on July 31, 2024. Chip was first nominated by one of the Thoma Bravo Funds to serve on our Board in 2015 and was most recently re-elected by our stockholders at our annual meeting in August 2022 for a three year term that was scheduled to expire in 2025. Seth Boro served on our Board as a nominee of one of the Thoma Bravo Funds for part of fiscal 2024 and resigned from the Board in February 2024 after serving as a director for just over nine years. The Thoma Bravo Fund that has previously nominated directors to our Board was not required to comply with the advance notice requirements with respect to the nomination of directors in our bylaws.

Board’s Risk Oversight Role

Risk is inherent to every business. We face a number of risks, including risks relating to our financial condition, development, and commercialization activities, operations, strategic direction, and intellectual property. Management is responsible for the day-to-day management of risks we face, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The role of our Board in overseeing the management of our risks is conducted primarily through committees of the Board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. The company has a comprehensive enterprise risk management (“ERM”) program to identify, prioritize as to likelihood and magnitude, and continuously monitor the various short-term and long-term risks that Dynatrace faces and how they are being addressed. The full Board (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management the company’s major risk exposures, their potential impact on Dynatrace, and the steps that the company is taking to manage them. When a committee of our Board is responsible for evaluating and overseeing the management of a particular risk or risks, the chair of the relevant committee reports on the committee meeting to the full Board. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

15

While the Board has ultimate risk oversight responsibility, the Board’s committees are primarily responsible for overseeing the following risk areas, among others:

| Board of Directors | |||||||||||

| Audit | Compensation | Cybersecurity | Nominating and Corporate Governance |

||||||||

|

•ERM process

•Financial, accounting and financial statement risk

•Legal and regulatory compliance risks

|

•Compensation program and practices risks

•Talent risks

|

•Cybersecurity risks

•Privacy and data protection risks

|

•Sustainability risks

•Governance risks

|

||||||||

Board’s Sustainability Oversight Role

We are committed to making a positive global impact. The table below shows how the top tier sustainability topics from our latest materiality assessment are overseen by the Board and three of its committees. The Nominating and Corporate Governance Committee provides primary oversight for our sustainability strategy, policies, practices, and related disclosures. For additional information about our sustainability practices, please see the “Sustainability” section of this Proxy Statement.

| Board | Audit | Cybersecurity | Nominating and Corporate Governance | |||||||||||

| Sustainability strategy, reporting, policies and practices | ü | |||||||||||||

| Board structure and composition | ü | |||||||||||||

| Data privacy and security | ü | ü | ||||||||||||

| Employee diversity | ü | |||||||||||||

| Employee training and development | ü | |||||||||||||

| Ethics and compliance | ü | ü | ü | |||||||||||

| Talent attraction and retention | ü | |||||||||||||

| Workplace culture | ü | |||||||||||||

Board Committees

The following table sets forth the current membership of the Board’s four committees as of June 28, 2024.

| Name | Audit | Compensation | Cybersecurity | Nominating and Corporate Governance |

||||||||||

| Michael Capone | µ | l | ||||||||||||

| Amol Kulkarni | l | l | ||||||||||||

| Stephen Lifshatz | µ | l | ||||||||||||

| Steve Rowland | l | |||||||||||||

| Kenneth “Chip” Virnig | l | |||||||||||||

| Jill Ward | l | µ | ||||||||||||

| Kirsten Wolberg | µ | l | ||||||||||||

µ = Chair; l = Member

16

Audit Committee

The Audit Committee of the Board’s (the "Audit Committee") responsibilities include:

•assisting the Board in its oversight of the integrity of our financial statements and our compliance with legal and regulatory requirements;

•assisting the Board in its oversight of the qualifications, independence, and performance of the Company’s independent auditors, being directly responsible for the appointment, retention, and termination of the independent auditors, and overseeing the work of the independent auditors;

•approving or, as required, pre-approving audit and permissible non-audit services, other than de minimis non-audit services, and the terms of such services, to be performed by our independent auditors;

•reviewing and discussing the overall audit plan with the independent auditors and with members of management responsible for preparing the company’s financial statements;

•reviewing and discussing the company’s annual audited financial statements and unaudited quarterly financial statements with the independent auditors and with members of management responsible for preparing the company’s financial statements;

•discussing our earnings releases and financial information and guidance provided to analysts and rating agencies;

•evaluating the performance, responsibilities, budget, and staffing of our internal audit function;

•reviewing the company’s ERM framework and major risk exposures, including the company’s ERM processes;

•establishing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; and

•reviewing and approving related party transactions.

Our Board has determined that each member of the Audit Committee is independent for Audit Committee purposes as that term is defined in applicable SEC and NYSE rules, and each is financially literate in accordance with NYSE rules.

Our Board has designated Steve Lifshatz as an “Audit Committee Financial Expert,” as defined under applicable SEC rules.

During the fiscal year ended March 31, 2024, the Audit Committee met nine times, made recommendations to the Board during Board meetings, and took other actions through written consent. The report of the Audit Committee is included in this Proxy Statement under “Report of the Audit Committee.” The members of the Audit Committee during our fiscal 2024 were Steve Lifshatz (Chair), Steve Rowland, and Jill Ward.

Compensation Committee

The Compensation Committee’s responsibilities include:

•overseeing the company’s overall compensation structure, policies and programs;

•reviewing and approving the terms and conditions of performance-based incentive plans and awards (subject, if applicable, to Board or stockholder approval);

•determining the measures on which performance-based incentive compensation and equity awards are based as well as reviewing and approving the achievement of those metrics and the resulting payouts;

•reviewing and establishing the objectives and performance criteria for the CEO;

•evaluating the performance of our CEO in light of the objectives and performance criteria that were set for the CEO, and determining the compensation of our CEO, in consultation with the Board;

•determining the compensation of other executive officers other than the CEO;

•reviewing and recommending to the Board the compensation of our directors; and

•reviewing and discussing with management, at least on an annual basis, management’s assessment of whether risks arising from the company’s compensation policies, practices and programs for all employees are reasonably likely to have a material adverse effect on the company.

Our Board has determined that each member of the Compensation Committee meets the requirements of a “non-employee director” pursuant to Rule 16b-3 under the Exchange Act and is “independent” for Compensation Committee purposes as that term is defined in the applicable SEC and NYSE rules.

17

During the fiscal year ended March 31, 2024, the Compensation Committee met four times, made recommendations to the Board during Board meetings, and took other actions through written consent. The members of the Compensation Committee during our fiscal 2024 were Mike Capone (Chair), Amol Kulkarni (from his appointment to the Board on September 1, 2023 through the end of fiscal 2024), Steve Lifshatz and Kirsten Wolberg (from the start of fiscal 2024 through September 1, 2023).

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee (Michael Capone, Amol Kulkarni, and Stephen Lifshatz) is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board or Compensation Committee.

Cybersecurity Committee

The Cybersecurity Committee’s responsibilities include:

•managing oversight of our investments, programs, plans, controls, and policies related to cybersecurity, data privacy, and data protection risks associated with our products, services, and business operations;

•providing feedback on cybersecurity related matters, including, but not limited to, strategies, objectives, capabilities, initiatives, and policies; and

•overseeing other tasks related to our cybersecurity and data privacy functions.

During the fiscal year ended March 31, 2024, the Cybersecurity Committee met six times and made recommendations to the Board during board meetings. The members of the Cybersecurity Committee during our fiscal 2024 were Kirsten Wolberg (Chair), Mike Capone, and Kenneth “Chip” Virnig. Chip Virnig will no longer serve as a member of the Cybersecurity Committee when he resigns from the Board on July 31, 2024.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s responsibilities include:

•identifying, evaluating, and recommending qualified persons to serve on our Board;

•considering and making recommendations to our Board regarding the composition and chairs of the committees of our Board;

•developing and making recommendations to our Board regarding corporate governance guidelines and matters and periodically reviewing such guidelines and recommending any changes;

•overseeing annual evaluations of the Board and its committees; and

•providing oversight of the company’s sustainability strategy and reporting; reviewing and assessing the company’s policies and practices regarding sustainability matters.

Our Board has determined that each member of the Nominating and Corporate Governance Committee is “independent” for Nominating and Corporate Governance Committee purposes as that term is defined in the rules of the SEC and the applicable NYSE rules.

During the fiscal year ended March 31, 2024, the Nominating and Corporate Governance Committee met seven times, made recommendations to the Board during Board meetings, and took other actions through written consent. The members of the Nominating and Corporate Governance Committee during our fiscal 2024 were Jill Ward (Chair), Ambika Kapur (through her resignation date of May 26, 2023), Amol Kulkarni (from his Board appointment on September 1, 2023), Kenneth “Chip” Virnig, and Kirsten Wolberg (from September 1, 2023). Chip Virnig stepped down from the committee in April 2024.

18

Our Director Nomination Process

The Nominating and Corporate Governance Committee regularly assesses the qualifications, experience, and skills of our current directors and the need for new directors. Related to this, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board, and recommending such persons to be nominated for election as directors, except where we are legally required by contract, law, or otherwise to provide third parties with the right to nominate.

The process followed by our Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by management, recruiters, members of the committee, and our Board. During fiscal 2024, our Nominating and Corporate Governance Committee engaged the services of a well known recruiting firm to assist in identifying, obtaining, and assessing background information relating to potential candidates.

The Nominating and Corporate Governance Committee uses the following guidelines to identify and evaluate any individual recommended for nomination to the Board:

•The current size and composition of the Board and the needs of the Board and its respective committees;

•Such factors as character, integrity, judgment, diversity (including diversity of gender identity or expression, race, ethnicity, age, and sexual orientation), independence, skills, education, expertise, business acumen, business experience, length of service, understanding of the company’s business and industry, conflicts of interest, and other commitments. The Nominating and Corporate Governance Committee need not assign any particular weight or priority to any one factor; and

•Any other factors that the Nominating and Corporate Governance Committee considers appropriate.

The qualifications that our Nominating and Corporate Governance Committee believes must be met by a committee-recommended nominee for a position on our Board are as follows:

•High standards of personal and professional ethics and integrity;

•Proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment;

•Skills that are complementary to those of the existing Board;

•The ability to assist and support management and make significant contributions to our success; and

•An understanding of the fiduciary responsibilities required of a director and a commitment to devote the time and energy necessary to perform those responsibilities.

When identifying potential new director nominees, the Nominating and Corporate Governance Committee considers, and requests that any search firm that it engages include in the pool of candidates, qualified candidates with diverse backgrounds, including, but not limited to, women and individuals who are racially or ethnically diverse.

In selecting nominees for directors, the Nominating and Corporate Governance Committee will review candidates properly recommended by stockholders in the same manner and using the same general criteria as candidates recruited by the committee and/or recommended by our Board. Any stockholder who wishes to recommend a candidate for consideration by the committee as a nominee for director should follow the procedures described in this Proxy Statement under the heading “Additional Information.” The Nominating and Corporate Governance Committee will also consider whether to nominate any person proposed by a stockholder in accordance with the provisions of our bylaws relating to stockholder nominations as described later in this Proxy Statement under the heading “Additional Information.”

Board and Committee Self-Assessments

The Board conducts an annual self-assessment to determine whether it and its committees are functioning effectively.

The Board Chair and the Nominating and Corporate Governance Committee initially determine the approach for the self-assessment process. Directors are then asked to evaluate the performance of the Board. Each committee also conducts its own self-assessment. Feedback from this process is reviewed by the Board Chair, who then provides a report to the full Board.

Following completion of the self-assessment process, the Chair and other directors develop appropriate action plans to address the feedback. Directors are also encouraged to provide ongoing feedback during the year outside of the formal self-assessment process.

19

Director Education

Our Board has a director continuing education program that provides opportunities to learn and stay current as Board members. As part of regularly scheduled Board/committee meetings, the Board periodically receives updates from outside legal counsel, the Compensation Committee’s independent consultant, and the company’s independent auditors. Directors are also informed through periodic updates and presentations provided by Dynatrace management regarding the company’s products, operations, performance, and industry.

As part of the Board’s individual director education approach, directors are encouraged to choose from among well-regarded third-party programs and seminars. Fees and reasonable out of pocket expenses are covered by our company and include membership in the National Association of Corporate Directors (NACD).

Newly appointed or elected directors also receive an orientation program in connection with joining the Board.

Director Stock Ownership Guidelines

Our non-employee directors are subject to stock ownership guidelines to further align their interests with those of our stockholders. Under the guidelines, our directors are required to hold common stock valued at a multiple of five times their current annual cash retainer fee for regular Board service (which excludes any supplemental annual cash retainers payable for Board or committee service) within five years of joining the Board. Compliance with this requirement will be determined on an annual basis on the last day of each fiscal year beginning on March 31, 2027.

For purposes of the guidelines, stock ownership only includes shares of common stock that a director either owns directly or otherwise beneficially owns and does not include shares of common stock underlying unvested time-based restricted stock units ("RSUs") and other unvested, unsettled and/or unexercised equity awards.

Attendance at Board and Committee Meetings and the Annual Meeting of Stockholders

During fiscal 2024, each member of the Board attended 75% or more of all meetings of the Board and each committee on which they served (during the period that the director served). Our Board met nine times during fiscal 2024.

Directors are encouraged to attend the annual meeting of stockholders to the extent practicable. Four of our eight directors serving on the Board at the time attended our 2023 annual meeting.

Other Corporate Governance Practices and Policies

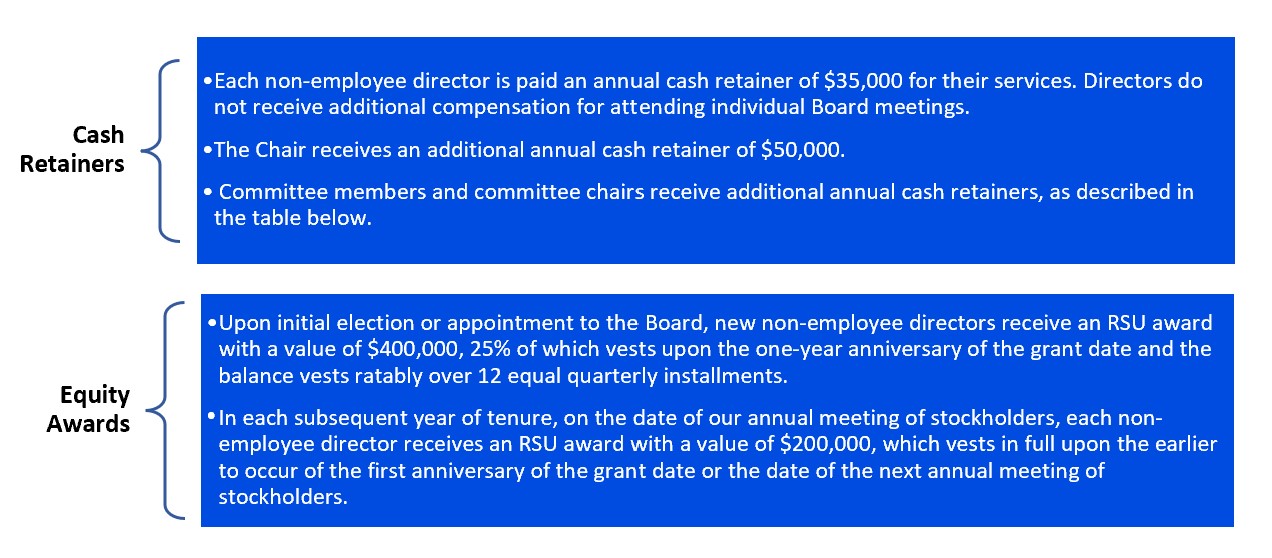

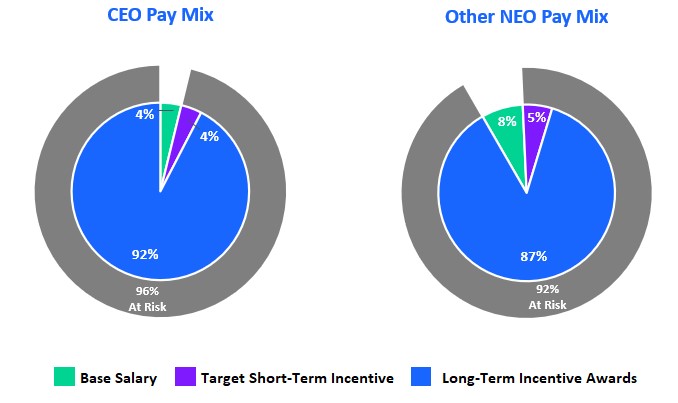

Stockholder Engagement