S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on July 31, 2019

Table of Contents

As filed with the Securities and Exchange Commission on July 31, 2019.

Registration No. 333-232558

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Dynatrace, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 47-2386428 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1601 Trapelo Road, Suite 116

Waltham, MA 02451

(781) 530-1000

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Craig Newfield

General Counsel

Dynatrace LLC

1601 Trapelo Road, Suite 116

Waltham, MA 02451

(781) 530-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Kenneth J. Gordon Joseph C. Theis, Jr. Goodwin Procter LLP 100 Northern Avenue Boston, MA 02210 (617) 570-1000 |

Bradley C. Reed, P.C. Michael P. Keeley Kirkland & Ellis LLP 300 North LaSalle Chicago, IL 60654 (312) 862-2000 |

Mark G. Borden David A. Westenberg Wilmer Cutler Pickering Hale and Dorr LLP 60 State Street Boston, MA 02019 (617) 526-6000 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☐ | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

|

||||||||

| Title of each Class of Securities to be Registered |

Amount to be |

Proposed Maximum |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

| Common Stock, par value $0.001 per share |

40,951,217 | $15.00 | $614,268,255.00 | $74,450 | ||||

|

|

||||||||

|

|

||||||||

| (1) | Includes 5,341,463 shares that the underwriters have an option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The registrant previously paid $74,450 in connection with the filing of this registration statement on July 30, 2019. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion. Dated July 31, 2019.

35,609,754 Shares

Common Stock

This is an initial public offering of common stock of Dynatrace, Inc.

We are offering 34,000,000 shares of common stock. The selling stockholders identified in this prospectus are offering an additional 1,609,754 shares of common stock. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $13.00 and $15.00. We have been approved to list our common stock on the New York Stock Exchange under the symbol DT.

Upon completion of this offering, affiliates of Thoma Bravo, LLC will own approximately 70.9% of our issued and outstanding shares of common stock, assuming the sale by us of 34,000,000 shares of common stock in this offering (or 69.7% of our issued and outstanding shares of common stock if the underwriters option to purchase additional shares from us is exercised in full). As a result, we will be a controlled company as defined under the New York Stock Exchange listing rules. See ManagementStatus as a Controlled Company.

We are an emerging growth company as defined under the federal securities laws, and as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to comply with reduced public company reporting requirements in future filings.

See Risk Factors beginning on page 22 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Initial Public Offering Price |

||||||||

| Underwriting discount(1) |

||||||||

| Proceeds, before expenses, to Dynatrace, Inc. |

||||||||

| Proceeds, before expenses, to the Selling Stockholders |

||||||||

| (1) | See the section titled Underwriting beginning on page 165 for a description of the compensation payable to the underwriters. |

To the extent the underwriters sell more than 35,609,754 shares of common stock, the underwriters will have the option to purchase up to an additional 4,871,138 shares from us and 470,325 shares from certain of the selling stockholders at the initial price to the public less the underwriting discount.

One or more funds affiliated with Dragoneer Investment Group, LLC have indicated an interest in purchasing an aggregate of up to $75.0 million in shares of our common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, one or more funds affiliated with Dragoneer Investment Group, LLC could determine to purchase more, less or no shares in this offering or the underwriters could determine to sell more, less or no shares to one or more funds affiliated with Dragoneer Investment Group, LLC. The underwriters will receive the same discount on any of our shares of common stock purchased by one or more funds affiliated with Dragoneer Investment Group, LLC as they will from any other shares of common stock sold to the public in this offering.

The underwriters expect to deliver the shares against payment in New York, New York on , 2019.

| Goldman Sachs & Co. LLC | J.P. Morgan | Citigroup |

| Barclays | Jefferies | RBC Capital Markets | UBS Investment Bank |

| KeyBanc Capital Markets | William Blair | Canaccord Genuity | JMP Securities | Macquarie Capital |

Prospectus dated , 2019

Table of Contents

| Page | ||||

| 1 | ||||

| 22 | ||||

| 56 | ||||

| 59 | ||||

| 61 | ||||

| 62 | ||||

| 64 | ||||

| 67 | ||||

| 70 | ||||

| Managements Discussion and Analysis of Financial Condition and Results of Operations |

73 | |||

| 101 | ||||

| 117 | ||||

| 124 | ||||

| 135 | ||||

| 140 | ||||

| 144 | ||||

| 147 | ||||

| 152 | ||||

| 158 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Common Stock |

160 | |||

| 165 | ||||

| 171 | ||||

| 171 | ||||

| 171 | ||||

| F-1 | ||||

Through and including , 2019 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealers obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide any information or make any representations other than the information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it.

We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

For investors outside of the United States: neither we, the selling stockholders, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

Unless the context otherwise requires, the terms Dynatrace, the Company, we, us and our in this prospectus refer to Dynatrace, Inc. and its consolidated subsidiaries after giving effect to the Spin-Off Transactions described herein. The term Thoma Bravo Funds refers to Thoma Bravo Fund X, L.P., Thoma Bravo Fund X-A, L.P., Thoma Bravo Fund XI, L.P., Thoma Bravo Fund XI-A, L.P., Thoma Bravo Executive Fund XI, L.P., Thoma Bravo Special Opportunities Fund I, L.P. and Thoma Bravo Special Opportunities Fund I AIV, L.P., and the term Thoma Bravo refers to Thoma Bravo, LLC, the management company and ultimate general partner of the Thoma Bravo Funds, and, unless the context otherwise requires, its affiliated entities. The term Dynatrace® refers to our Software Intelligence Platform.

ii

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled Risk Factors and Managements Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

DYNATRACE, INC.

Overview

We offer the market-leading software intelligence platform, purpose-built for the enterprise cloud. As enterprises embrace the cloud to effect their digital transformation, our all-in-one intelligence platform is designed to address the growing complexity faced by technology and digital business teams. Our platform utilizes artificial intelligence at its core and advanced automation to provide answers, not just data, about the performance of applications, the underlying hybrid cloud infrastructure, and the experience of our customers users. We designed our software intelligence platform to allow our customers to modernize and automate IT operations, develop and release high quality software faster, and improve user experiences for better business outcomes. As a result, as of March 31, 2019, our products are trusted by more than 2,300 customers in over 70 countries in diverse industries such as banking, insurance, retail, manufacturing, travel and software.

Todays leading companies are striving to deliver innovative, high performance digital services that expand market opportunities, to compete more effectively, and to operate with increased agility. Software is increasingly central to how enterprises seek to accomplish these goals. Applications sit at the core of this software revolution and are central to the digital transformation of these enterprisesfrom the mission critical enterprise applications that power factories, enable trading, manage transportation networks, and run business systems to the applications that consumers use every day to bank, shop, entertain, travel, and more.

Developing and operating software is harder than ever, largely driven by:

| 1) | Cloud Transformation: Enterprises are building and deploying software across multiple public and on-premise platforms, creating significant visibility challenges across all of an enterprises hosted environments. |

| 2) | Application Complexity: Applications are increasingly complex and deployed as microservices-based architectures that are written in multiple different programming languages with hundreds of loosely coupled service connections. The scale of this complexity is heightened by the advent of the Internet of Things, which increases the number of potential sources of application failure. |

| 3) | DevOps: Ensuring that software updates work without issues has grown more challenging due to the increased frequency of software releases, reduced testing time, and the use of independent development teams. |

| 4) | User Experience: User expectations for software performance have rapidly increased and enterprises are focused on advancing branded experiences to maximize revenue, differentiate offerings, and retain competitive positions. |

1

Table of Contents

Traditional approaches for developing, operating, and monitoring software were not designed for the enterprise cloud environment. Traditional monitoring solutions were developed in an era in which applications were monolithic, updated infrequently, and run in static data center environments. These monitoring solutions, including application performance monitoring, or APM, infrastructure monitoring, incident and alert management, and user experience monitoring, are difficult to deploy, narrow in scope, and were designed to operate in a simpler, siloed environment. Each tool in this approach only collects data about individual components of the computing stack, such as applications, infrastructures, logs, networks, or user experiences. In order to get an end-to-end view using these traditional approaches, IT teams are required to aggregate and correlate data from these disparate monitoring solutions in an attempt to identify actionable answers, including where bottlenecks occur, how best to optimize for performance and scalability, if an issue is impacting service, and if so, where to find the problem and what to do about it.

With the advent of the enterprise cloud, the challenges and limitations of traditional solutions have been exacerbated. What was once a well understood layering of applications running on operating systems on physical servers connected to physical networks has rapidly become virtualized into software at all levels. Environments have become dynamic. Applications are no longer monolithic and are fragmented into dozens to potentially thousands of microservices, written in multiple software languages. These enterprise cloud environments sprawl from traditional backend applications run on relational databases and mainframes to modern IaaS platforms run on Amazon Web Services, or AWS, Microsoft Azure, or Azure, and Google Cloud Platform. All these factors result in an environment that is web-scale, extremely complex, and dynamic at all layers of the new computing stack.

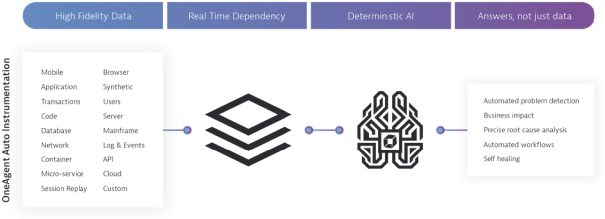

We believe the scale, complexity, and dynamic nature of this emerging enterprise cloud environment, including the applications that run on it, require a comprehensive monitoring strategy that we refer to as software intelligence. Starting in 2014, we leveraged the knowledge and experience of the same engineering team that founded Dynatrace to develop a solution to address the disruptive shift to the enterprise cloud. These efforts resulted in the creation of a new platform, the Dynatrace Software Intelligence Platform, or Dynatrace®. Dynatrace® leverages an automatic instrumentation technology that we call OneAgent®, a real-time dependency mapping system we call SmartScape®, our transaction-centric code analysis technology that we call PurePath®, and an open artificial intelligence, or AI, engine that we call DavisTM for instant answers to degradations in service, anomalies in behavior, and user impact. Dynatrace® simplifies the complexity of the enterprise cloud for cloud architects, application teams and operations teams, while providing actionable insights that accelerate cloud migrations, cloud adoption, and DevOps success.

Unlike traditional multi-tool approaches, Dynatrace® has been integrated with key components of the enterprise cloud ecosystem to support dynamic cloud orchestration, including for AWS, Azure, Google Cloud Platform, Pivotal Cloud Foundry, Red Hat OpenShift, and Kubernetes. In these environments, Dynatrace® automatically launches and monitors the full cloud stack and all the applications and containers running anywhere in the stack, including applications and workloads that may traverse multiple cloud and hybrid environments. We believe that our ability to integrate Dynatrace® with cloud platforms simplifies development and operational efforts, increases visibility, and improves situational awareness for our customers.

We designed Dynatrace® to maximize flexibility and control of the rich monitoring data captured and analyzed by our platform. We believe that it provides the simplicity of software-as-a-service, or SaaS, with the customer option of either maintaining data in the cloud, or at the edge in customer-provisioned infrastructure, which we refer to as Dynatrace® Managed. In this managed offering, we provide updates and enhancements automatically on a monthly basis while allowing customers the flexibility and control to adhere to their own data security and sovereignty requirements.

2

Table of Contents

We market Dynatrace® through a combination of our global direct sales team and a network of partners, including resellers, system integrators, and managed service providers. We target the largest 15,000 global enterprise accounts, which generally have annual revenues in excess of $750 million.

The Dynatrace Software Intelligence Platform has been commercially available since 2016 and is now our primary offering. The number of Dynatrace® customers increased to 1,364 as of March 31, 2019 from 574 as of March 31, 2018, representing year-over-year growth of 138%. As of March 31, 2019, approximately 53% of Dynatrace® customers added to the platform since April 1, 2017 were new customers, and the remaining 47% were existing customers that either added or converted to Dynatrace®. Our Dynatrace® dollar-based net expansion rate was 140% as of March 31, 2019. See section titled Managements Discussion and Analysis of Financial Condition and Results of OperationsKey Metrics.

Our subscription revenue for the years ended March 31, 2017, 2018, and 2019 was $232.8 million, $257.6 million, and $349.8 million, respectively, representing 57%, 65%, and 81%, respectively, of total revenue and year-over-year growth of 11% and 36%. Our total revenue for the years ended March 31, 2017, 2018, and 2019 was $406.4 million, $398.0 million, and $431.0 million, respectively, representing a year-over-year decline of 2% and a year-over-year increase of 8%.

We had net income (loss) of $0.8 million, $9.2 million, and $(116.2) million for the years ended March 31, 2017, 2018, and 2019, respectively. Our adjusted EBITDA for the years ended March 31, 2017, 2018, and 2019 was $108.3 million, $92.8 million, and $92.9 million, respectively, representing 26.6%, 23.3%, and 21.5%, respectively, of total revenue. See section titled Non-GAAP Financial Measures for information regarding our use of adjusted EBITDA and the reconciliation of this measure to net income (loss) determined in accordance with generally accepted accounting principles in the United States, or GAAP.

Industry Background

Key trends impacting the way enterprises develop, manage, and optimize their software environment include:

Software Applications Are Central to Digital Transformation for Businesses Across All Sectors

Whether it is retailers driving higher customer engagement through mobile apps, industrial companies reducing production downtime with predictive maintenance applications, or automobile manufacturers designing self-driving cars, software is central to how enterprises deliver a differentiated user experience. At the same time, software is increasingly embedded throughout the enterprise, managing business critical systems, such as payments processing, inventory and supply chain management, logistics, and many other front- and back-office operations.

Enterprises now focus more of their budget on software innovation and less on operating and maintaining systems in order to remain competitive. As a result, enterprises are investing in new platforms that are built to automate the development, deployment, and operation of modern software applications and accelerate the transition to the enterprise cloud. Further, maintaining visibility across a broad hybrid cloud environment represents a significant challenge, which we believe is a primary reason why digital transformations are slow, often disrupted by performance issues, and can fail to achieve intended objectives.

3

Table of Contents

Changing Customer Expectations are Requiring Enterprises to Prioritize the User Experience

Enterprises are increasingly seeking to differentiate their products and services based on user experiences, with digital interaction becoming the primary channel of communication between enterprises and their customers, partners, and employees. User experience is closely tied to the performance of software applications. As a result, optimal application performance and exceptional user experiences are important to the entire enterprise, not just to the IT staff that maintain these applications. We believe that the need for an exceptional user experience to engage and retain customers will continue to drive demand for instrumentation that helps enterprises to provide high quality, user-focused outcomes.

Benefits of the Enterprise Cloud Make it Essential for Digital Transformation

Enterprises are increasingly adopting cloud technologies to increase agility and accelerate innovation. The key advantages of an enterprise cloud include:

| | Ability to build better applications at a faster rate. Cloud-based application development technologies such as container and microservices architectures, enable enterprises to focus developer resources more on creating and improving value-add application features and less on managing underlying operating systems and infrastructure. In addition to new cloud-based development technologies, enterprises are adopting new processes such as DevOps and Artificial Intelligence for IT Operations, or AIOps, that help accelerate the software delivery cycle. |

| | Operational efficiency. Enterprises are moving to the cloud to be more agile and to reduce spending on expensive and static systems, as well as the IT staff needed to maintain them. Furthermore, cloud services can be purchased dynamically as demand ebbs and flows over time, affording greater flexibility, financial efficiencies, and scale than traditional systems. |

Shift to Enterprise Cloud Introduces Fundamentally New Software Delivery Challenges

While the cloud offers enterprises some clear advantages over traditional systems, moving to the cloud also creates fundamental new challenges, such as:

| | Greater complexity. Hybrid cloud strategies require that IT teams manage applications and ensure interoperability of operations between private and multiple public clouds, such as AWS, Azure, Google Cloud Platform, or SAP Cloud platform. In addition, these applications are containerized and increasingly fragmented into microservices that are hosted across multiple cloud platforms, creating interdependencies across heterogeneous environments that increase the risk of incompatibility issues and the number of potential failure points if the applications are not deployed and maintained correctly. |

| | Highly dynamic environments. Cloud infrastructure and applications are built to scale up or down in real-time depending upon usage and traffic. The automation required to monitor these highly dynamic environments is beyond what is required for monolithic, on-premise applications. |

| | Massive scale. As software becomes more critical to business success, the number and size of applications will continue to grow and encompass more features and greater functionality. At the same time, web-scale architectures are enabling enterprises to build applications that are deployed across thousands of hosts and serve millions of users simultaneously. The breadth of functionality and scale of deployments of enterprise cloud applications regularly exceed even the largest applications built in the pre-cloud era. |

4

Table of Contents

| | More frequent changes to software. The adoption of DevOps practices and cloud architectures have increased the speed at which software updates can be developed and deployed. With the application development lifecycle accelerating, enterprises must adapt their software operations environment and culture to ensure that performance and business outcomes are not adversely affected by frequent changes. |

Traditional Monitoring Approaches Were Not Built for the Modern Enterprise Cloud

Traditional application monitoring approaches were built before the enterprise cloud was the driving force in digital transformation, and suffer from significant shortcomings when applied in cloud-based environments. Challenges of traditional monitoring solutions for the enterprise cloud include:

| | Manual configuration processes that do not scale. Traditional monitoring tools require unique agents for each component of an application and rely on IT personnel to manually pre-configure each agent. The complexity and dynamic nature of enterprise cloud applications, which can include thousands of containers and microservices, makes this multi-agent approach costly, slow, and impractical to install and maintain, especially as these applications are rapidly modified and updated. |

| | Not designed to capture data across the full application stack. Traditional APM solutions were created to view a limited portion of the full software stack and provide visibility only into individual applications, without providing visibility into how the applications are interconnected. In order to get a complete view of all applications, from the underlying infrastructure to the user experience, IT personnel are required to manually implement and manage many disparate tools. We believe this approach has resulted in enterprises overinvesting in operations and underinvesting in development, which slows innovation. |

| | Only able to provide data, not answers. Traditional monitoring tools provide data only about narrow components of the technology stack. As a result, IT teams must manually integrate and correlate the data from disparate systems and apply their own assumptions to identify the underlying cause of performance issues. This process is slow, prone to errors, and is made especially challenging by the complexity of enterprise cloud applications. |

| | Collect limited snapshots of data that do not provide real-time visibility. Traditional APM tools were not designed for the far larger and more complex data sets produced by enterprise cloud applications and can only capture snapshots of application performance or user data. This approach requires these tools to rely on partial data sets, reducing their effectiveness in performing precise root-cause determination, adding risk, and delaying innovation. In addition, traditional monitoring tools do not provide visibility into containers and microservices, which leads to blind spots in software performance monitoring when used in closed-based environments. |

| | Lack of flexible deployment options. Traditional monitoring solutions are either deployed as SaaS-only or on-premise-only. SaaS-only solutions often fail to meet the strict governance, security, and scale requirements of large enterprises, and were not built to monitor on-premise applications, making them incompatible with the needs of customers who manage hybrid-hosted applications. Conversely, traditional on-premise solutions were not built to manage cloud applications and are typically upgraded less frequently and thus innovate more slowly than cloud-based applications. |

Our Solution

We offer the market-leading software intelligence platform, purpose-built for the enterprise cloud. We built our Dynatrace Software Intelligence Platform from the ground up to meet the challenges of

5

Table of Contents

running an enterprise cloud. Our AI-powered, full-stack, and completely automated platform provides deep insight into dynamic, web-scale, hybrid cloud ecosystems. Dynatrace® is able to provide real-time actionable insights about the performance of our customers entire software ecosystem by integrating high fidelity, web-scale data, mapping its dependencies in real-time, and analyzing them with an open, deterministic AI engine. Dynatrace® is brought to market through our global direct sales force and a network of partners. The combination of our market-leading platform and go-to-market strategy has allowed us to achieve the scale, growth, and margins that we believe will provide us the capital to continue investing in driving further product differentiation.

Our platform provides the following key benefits:

| | Single agent, fully automated configuration. Dynatrace® is installed as a single agent, which we refer to as OneAgent®, that automatically configures itself, discovering all components of the full-stack to enable high fidelity and web-scale data capture. OneAgent® dynamically profiles the performance of all components of the full-stack with code-level precision, even as applications and environments change. |

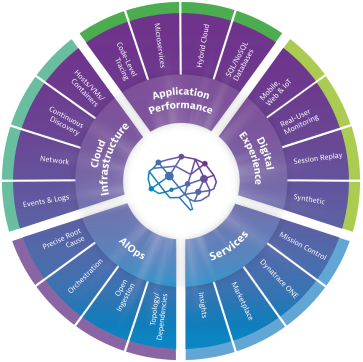

| | Full-stack, all-in-one approach with deep cloud integrations. Dynatrace® combines APM with Cloud Infrastructure Monitoring, AIOps, and Digital Experience Management, or DEM, in a single full-stack approach. We believe that this all-in-one approach reduces the need for a variety of disparate tools and enables our customers to improve productivity and decision making while reducing operating costs. Dynatrace® provides out-of-the-box configuration for the leading cloud platforms, such as AWS, Azure, Google Cloud Platform, Red Hat OpenShift, Pivotal Cloud Foundry, and SAP Cloud Platform, as well as coverage for traditional on-premise mainframe and monolithic applications in a single, easy-to-use, intelligent platform. |

| | AI-powered, answer-centric insights. DavisTM, our deterministic AI engine, dynamically baselines the performance of all components in the full-stack, continually learning normal performance thresholds in order to provide precise answers when performance deviates from expected or desired conditions. Unlike correlation engines that overwhelm IT professionals with dozens of alerts from many different tools, Dynatrace® provides a single problem resolution and precise root cause determination. We believe that the accuracy and precision of the answers delivered by our AI engine enable our customers to program automated remediation actions, taking a significant step towards our vision of autonomous cloud operations and accelerating the DevOps transformation. |

| | Web-scale and enterprise grade. Dynatrace® utilizes big data architecture and enterprise-proven cloud technologies that are engineered for web-scale environments. With role-based access and advanced security functionality, Dynatrace® was purpose-built for enterprise wide adoption. |

| | Flexible deployment options. We deploy our platform as a SaaS solution, with the option of retaining the data in the cloud, or at the edge in customer-provisioned infrastructure, which we refer to as Dynatrace® Managed. The Dynatrace® Managed offering allows customers to maintain control of the environment where their data resides, whether in the cloud or on-premise, combining the simplicity of SaaS with the ability to adhere to their own data security and sovereignty requirements. Our Mission Control center automatically upgrades all Dynatrace® instances and offers on-premise cluster customers auto-deployment options that suit their specific enterprise management processes. |

6

Table of Contents

Our Opportunity

We believe that our full-stack, all-in-one, software intelligence platform, Dynatrace®, has the ability to expand our potential market opportunity by allowing us to offer our solutions into adjacent markets beyond APM, replacing traditional monitoring tools, and potentially disrupting various well-established IT spending categories, such as infrastructure monitoring, alert and incident management, and network monitoring as enterprise cloud computing replaces traditional data centers. According to Gartner, the global IT operations software market in 2019 is estimated to be $29 billion and is expected to grow at a compound annual growth rate of 6.7% to $37.5 billion in 2023.

We believe a significant portion of our market opportunity remains unpenetrated today. According to Gartner, enterprises will quadruple their APM use due to increasingly digitized business processes from 2018 through 2021, to reach 20% of all business applications. As this trend continues, we believe there is an opportunity to increase our annual recurring revenue as enterprise customers expand the number of applications instrumented.

We estimate that the annual potential market opportunity for our Dynatrace® solution is currently approximately $18 billion. We calculated this figure using the largest 15,000 global enterprises with greater than $750 million in annual revenue, as identified by S&P Capital IQ in February 2019. We then banded these companies by revenue scale, and multiplied the total number of companies in each band by our calculated annualized booking per customer for companies in each respective band. The calculated annualized bookings per customer applied for each band is calculated using internal company data of actual customer spend. For each respective band, we calculate the average annualized bookings per customer of the top 10% of customers in the band, which we believe to be representative of having achieved broader implementation of our solutions within their enterprises. We believe our potential market opportunity could expand further as enterprises increasingly instrument, monitor, and optimize more of their applications and underlying infrastructure.

Our Growth Strategy

| | Extend our technology and market leadership position. We intend to maintain our position as the market-leading software intelligence platform through increased investment in research and development and continued innovation. We expect to focus on expanding the functionality of Dynatrace® and investing in capabilities that address new market opportunities. We believe this strategy will enable new growth opportunities and allow us to continue to deliver differentiated high-value outcomes to our customers. |

| | Grow our customer base. We intend to drive new customer growth by expanding our direct sales force focused on the largest 15,000 global enterprise accounts, which generally have annual revenues in excess of $750 million. In addition, we expect to leverage our global partner ecosystem to add new customers in geographies where we have direct coverage and work jointly with our partners. In other geographies, we utilize a multi-tier master reseller model, such as in Africa, Japan, the Middle East, Russia, and South Korea. |

| | Increase penetration within existing customers. We plan to continue to increase penetration within our existing customers by expanding the breadth of our platform capabilities to provide for continued cross-selling opportunities. In addition, we believe the ease of implementation for Dynatrace® provides us the opportunity to expand adoption within our existing enterprise customers, across new customer applications, and into additional business units or divisions. Once customers are on the Dynatrace® platform, we have seen significant dollar-based net expansion due to the ease of use and power of our new platform. |

7

Table of Contents

| | Enhance our strategic partner ecosystem. Our strategic partners include industry-leading system integrators, software vendors, and cloud and technology providers. We intend to continue to invest in our partner ecosystem, with a particular emphasis on expanding our strategic alliances and cloud-focused partnerships, such as AWS, Azure, Google Cloud Platform, Red Hat OpenShift, and Pivotal Cloud Foundry. |

Our Sponsor

Thoma Bravo is a leading investment firm building on a more than 35-year history of providing capital and strategic support to experienced management teams and growing companies. Thoma Bravo has invested in many fragmented, consolidating industry sectors in the past, but has become known particularly for its history of successful investments in the application, infrastructure and security software and technology-enabled services sectors, which have been its investment focus for more than 15 years. Thoma Bravo manages a series of investment funds representing more than $30 billion of capital commitments.

Risks Affecting Us

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations and prospects. You should carefully consider the risks described under the heading Risk Factors included elsewhere in this prospectus. These risks include, among others:

| | We have experienced rapid subscription revenue growth in recent periods, and our recent growth rates may not be indicative of our future growth. |

| | Our substantial level of indebtedness could materially and adversely affect our financial condition. |

| | Market adoption of software intelligence solutions for application performance monitoring, digital experience monitoring, infrastructure monitoring, and AIOps is relatively new and may not grow as we expect, which may harm our business and prospects. |

| | Our business is dependent on overall demand for software intelligence solutions and therefore reduced spending on software intelligence solutions or overall adverse economic conditions may negatively affect our business, operating results and financial condition. |

| | If we cannot successfully execute on our strategy and continue to develop and effectively market solutions that anticipate and respond to the needs of our customers, our business, operating results and financial condition may suffer. |

| | We may experience a loss of customers and annualized recurring revenue as customers convert from our Classic products to our Dynatrace® platform. |

| | We face significant competition which may adversely affect our ability to add new customers, retain existing customers and grow our business. |

| | Failure to protect and enforce our proprietary technology and intellectual property rights could substantially harm our business, operating results and financial condition. |

| | We expect to be a controlled company within the meaning of the New York Stock Exchange rules and, as a result, will qualify for and intend to rely on exemptions from certain corporate governance requirements. Upon the completion of this offering, our executive officers, |

8

Table of Contents

| directors, and Thoma Bravo will beneficially own approximately 73.5% of our issued and outstanding shares of common stock, assuming the sale by us of 34,000,000 shares of common stock in this offering. |

| | Thoma Bravo has a controlling influence over matters requiring stockholder approval, which may have the effect of delaying or preventing changes of control, or limiting the ability of other stockholders to approve transactions they deem to be in their best interest. |

Recent Operating Results (preliminary and unaudited)

Set forth below are selected preliminary consolidated unaudited financial results for the three months ended June 30, 2019. Our consolidated financial results for the three months ended June 30, 2019 are not yet available. The following information reflects our preliminary estimates with respect to the results for the three months ended June 30, 2019, which are based on currently available information and are subject to change. We have provided ranges, rather than specific amounts, for the preliminary results described below primarily because our financial closing procedures for the three months ended June 30, 2019 are not yet complete and, as a result, our final results upon completion of our closing procedures may vary from the preliminary estimates. These estimates should not be viewed as a substitute for interim financial statements prepared in accordance with GAAP.

This selected preliminary consolidated financial data has been prepared by, and is the responsibility of, our management. BDO USA LLP has not audited, reviewed, compiled or applied agreed-upon procedures with respect to this preliminary consolidated financial data. Accordingly, BDO USA LLP does not express an opinion or any other form of assurance with respect thereto.

The following are the selected preliminary unaudited financial results for the three months ended June 30, 2019, as well as a comparison to our unaudited financial results for the three months ended June 30, 2018:

|

Three Months Ended June 30, |

||||||||||||

| 2018 |

2019 (estimated) |

|||||||||||

| Low | High | |||||||||||

| (in thousands) | ||||||||||||

| Revenues: |

||||||||||||

| Subscriptions |

$ | 77,924 | $ | 106,500 | $ | 107,100 | ||||||

| License |

11,079 | 3,550 | 3,850 | |||||||||

| Services |

9,218 | 10,450 | 10,550 | |||||||||

| Total revenue |

98,221 | 120,500 | 121,500 | |||||||||

| Net loss |

(23,556 | ) | (50,400 | ) | (53,800 | ) | ||||||

| Adjusted EBITDA |

16,012 | 27,000 | 28,000 | |||||||||

9

Table of Contents

The following table reflects the reconciliation of adjusted EBITDA to net loss calculated in accordance with GAAP:

| Three Months Ended June 30, |

||||||||||||

| 2018 | 2019 (estimated) |

|||||||||||

| Low | High | |||||||||||

| (in thousands) | ||||||||||||

| Net loss |

$ | (23,556 | ) | $ | (50,400 | ) | $ | (53,800 | ) | |||

| Income tax benefit |

(3,483 | ) | (3,000 | ) | (3,000 | ) | ||||||

| Interest expense, net |

10,687 | 19,000 | 20,000 | |||||||||

| Amortization |

18,343 | 15,000 | 15,200 | |||||||||

| Depreciation |

1,943 | 1,900 | 2,100 | |||||||||

| Restructuring and other |

410 | | | |||||||||

| Transaction and sponsor related costs |

1,333 | 3,500 | 4,500 | |||||||||

| (Gain) loss on currency translation |

(2,863 | ) | | | ||||||||

| Share-based compensation |

13,198 | 41,000 | 43,000 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 16,012 | $ | 27,000 | $ | 28,000 | ||||||

|

|

|

|

|

|

|

|||||||

The following are the preliminary number of Dynatrace® Customers and Total ARR as of June 30, 2019, as well as a comparison to the comparable metric as of June 30, 2018:

| As of June 30, | ||||||||||||

| 2018 |

2019 (estimated) |

|||||||||||

| Low | High | |||||||||||

| Number of Dynatrace® Customers |

733 | 1,560 | 1,570 | |||||||||

| Total ARR (in thousands) |

$ | 306,103 | $ | 430,000 | $ | 435,000 | ||||||

The increase in revenue from the three months ended June 30, 2018 to the three months ended June 30, 2019 is primarily due to the growing adoption of the Dynatrace® platform by new customers combined with existing customers expanding their use of our solutions.

The increase in net loss from the three months ended June 30, 2018 to the three months ended June 30, 2019 is primarily due to higher share-based compensation and increased personnel and other costs to support the expansion of our product offerings. For the three months ended June 30, 2019, we estimate our share-based compensation expense to be between $41.0 million and $43.0 million, based on an estimated fair value of approximately $7.71 for outstanding equity awards as of June 30, 2019. The estimated fair value as of June 30, 2019, was determined by our board of directors using a combination of the probability-weighted expected return method, or PWERM, and the option-pricing model, or OPM, which we refer to as the hybrid method. In the hybrid method, our board of directors considered the initial public offering as a potential future liquidity event. The relative probability of the initial public offering scenario was determined based on an analysis of market conditions as of June 30, 2019, and our expectations as to the timing and likely prospects of the initial public offering as of June 30, 2019. The difference between the estimated fair value of $7.71 and the assumed initial public offering price of $14.00 per share (the midpoint of the estimated offering price range set forth on the cover page of this prospectus) is primarily attributable to the hybrid method providing equal weighting to the PWERM and the OPM representing 50% probability attributed to the initial public offering as of June 30, 2019. See section titled Managements Discussion and Analysis of Financial Condition and

10

Table of Contents

Results of Operations Critical Accounting Policies and Estimates Share-based Compensation for more information about our share-based compensation methodology.

Assuming an initial public offering price of $14.00 per share (the midpoint of the estimated offering price range set forth on the cover page of this prospectus), we expect to recognize a one-time incremental share-based compensation expense of $110.0 million to $120.0 million during the three months ending September 30, 2019 in connection with the mark-to-market method of accounting for outstanding equity awards at June 30, 2019. This incremental expense is in addition to the regular share-based compensation expense we will recognize for the three months ending September 30, 2019. The remaining unrecognized compensation expense of approximately $49.0 million for these awards as well as incremental costs associated with awards granted in connection with the 2019 Equity Incentive Plan will be recognized prospectively over the remaining requisite service period.

As of June 30, 2019, our cash and cash equivalents were $57.5 million and our long term debt, net of current portion, was $1.017 billion.

The selected preliminary consolidated financial data presented above for the three months ended June 30, 2019 is preliminary, is not a comprehensive statement of our financial results and is subject to completion of our financial closing procedures. While we have not identified any unusual events or trends that occurred during the periods that might materially affect these preliminary estimates, our actual results for the three months ended June 30, 2019 will not be available until after this offering is completed. Accordingly, these results may change, and those changes may be material. Further, our preliminary estimated results are not necessarily indicative of the results to be expected for the remainder of fiscal year 2020 or any future period as a result of various factors, including, but not limited to, those discussed in the sections titled Risk Factors, Managements Discussion and Analysis of Financial Condition and Results of Operations and Special Note Regarding Forward-Looking Statements. Accordingly, you should not place undue reliance upon these preliminary estimates.

Corporate Information

Our principal executive offices are located at 1601 Trapelo Road, Suite 116, Waltham, MA 02451 and our telephone number at that address is (781) 530-1000. Our website address is www.dynatrace.com. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus, and inclusions of our website address in this prospectus are inactive textual references only.

The Dynatrace design logo and our other registered or common law trademarks, service marks or trade names appearing in this prospectus are the property of Dynatrace LLC. This prospectus includes our trademarks and trade names, including, without limitation, Dynatrace®, OneAgent®, SmartScape®, PurePath® and Davis, which are our property and are protected under applicable intellectual property laws. Other trademarks and trade names referred to in this prospectus are the property of their respective owners.

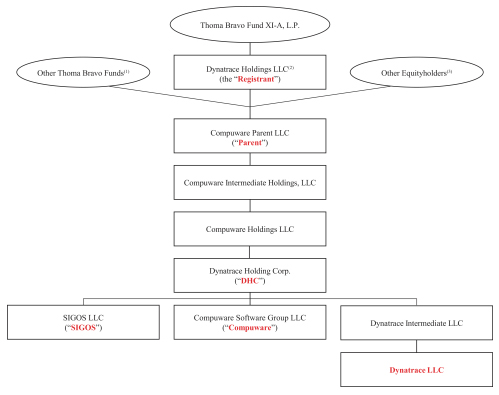

Spin-Off Transactions

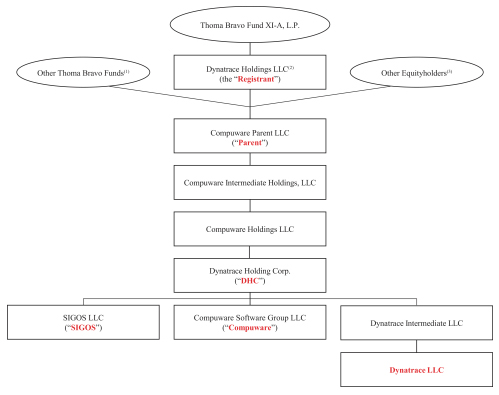

Prior to July 30, 2019, Compuware Parent, LLC, or Parent, through its wholly owned indirect subsidiary Dynatrace Holding Corp., or DHC, owned and operated three separate and distinct businesses through three indirect subsidiaries: (i) Dynatrace LLC, the principal operating company of our business, (ii) Compuware Software Group LLC, or Compuware, and (iii) SIGOS LLC, or SIGOS.

11

Table of Contents

Dynatrace Holdings LLC was a direct and indirect equityholder of Parent that elected to be treated as a corporation for U.S. federal income tax purposes and, after the completion of the transactions described below, converted into a Delaware corporation with the name Dynatrace, Inc., the issuer of the shares offered pursuant to this prospectus.

In June 2019, DHC, through a series of transactions, distributed to Parent, and Parent spun-off and distributed to certain of its equityholders (including the Thoma Bravo Funds), all of the equity interests of SIGOS (this transaction is referred to as the SIGOS Spin-Off). In connection with the SIGOS Spin-Off, all outstanding intercompany receivables and payables between SIGOS or its subsidiaries, on the one hand, and Dynatrace, Compuware or its respective subsidiaries, on the other hand, were extinguished.

On or prior to July 31, 2019, and prior to the effectiveness of the registration statement of which this prospectus is a part, Parent, DHC, Compuware, we, and the other direct and indirect equityholders of Parent effected the following transactions which resulted in (i) the spin-off of Compuware as a separate company to the equityholders of Parent and (ii) Dynatrace, Inc. becoming the ultimate parent company of Dynatrace LLC:

| | through a series of transactions, all of the equityholders of Parent (including the Thoma Bravo Funds) received units of Dynatrace Holdings LLC (or, in the case of Dynatrace employees, directors and other service providers who hold equity awards in Parent, the right to receive a new equity award under our 2019 Equity Incentive Plan that is equivalent in value to such equity award in Parent) in exchange for their equity interests and/or incentive equity awards of Parent, and Parent merged with and into DHC, with DHC surviving the merger; |

| | DHC, through a series of transactions, distributed to Dynatrace Holdings LLC, and Dynatrace Holdings LLC spun-off and distributed to its equityholders (including the Thoma Bravo Funds), all of the equity interests of Compuware (this transaction is referred to as the Compuware Spin-Off); |

| | Compuware distributed to us an amount equal to $265.0 million, which represents $265.0 million of the estimated $275.0 million tax payable by us in connection with the Compuware Spin-Off, and all outstanding intercompany receivables and payables between Dynatrace or its subsidiaries, on the one hand, or Compuware and its subsidiaries, on the other hand, were extinguished; and |

| | Dynatrace Holdings LLC converted into a Delaware corporation with the name of Dynatrace, Inc., and the unit holders of Dynatrace Holdings LLC became holders of shares of common stock of Dynatrace, Inc. |

The foregoing transactions, together with the SIGOS Spin-Off, are collectively referred to herein as the Spin-off Transactions.

Estimated corporate-level U.S. federal, state and local taxes of approximately $275.0 million (based on valuation estimates as of March 31, 2019) are payable by us in connection with the Compuware Spin-Off. Compuware distributed $265.0 million to us concurrently with the Compuware Spin-Off to pay a portion of this liability. Of this estimated tax liability, we expect to pay $265.0 million to the applicable taxing authorities during the three months ending September 30, 2019, and the balance will be due by no later than March 2020. However, our actual tax liability relating to the Compuware Spin-Off will not be determined until we complete our applicable tax returns with respect to the taxable period that includes the Compuware Spin-Off. We will be solely responsible for any amount of taxes owed in excess of the amount we receive from Compuware prior

12

Table of Contents

to this offering. We do not expect to incur any material tax liabilities in connection with the SIGOS Spin-Off because we estimate that the fair market value of the SIGOS assets as of the date of the SIGOS Spin-Off was materially similar to the adjusted tax basis in such assets. See Risk FactorsRisks Related to Our BusinessThe Compuware Spin-Off and the SIGOS Spin-Off are taxable transactions for us, and we will be subject to tax liabilities in connection with such transactions.

The following diagram shows our organizational structure immediately prior to giving effect to the Spin-Off Transactions.

| (1) | Includes special purpose investment entities wholly-owned by certain Thoma Bravo Funds. |

| (2) | Dynatrace Holdings LLC converted into a corporation with the name Dynatrace, Inc. on July 31, 2019. |

| (3) | Includes employee equityholders and other equityholders who invested alongside the Thoma Bravo Funds. |

13

Table of Contents

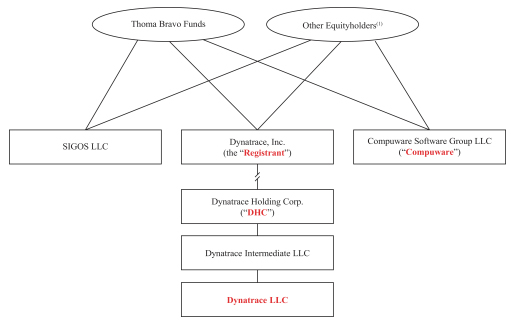

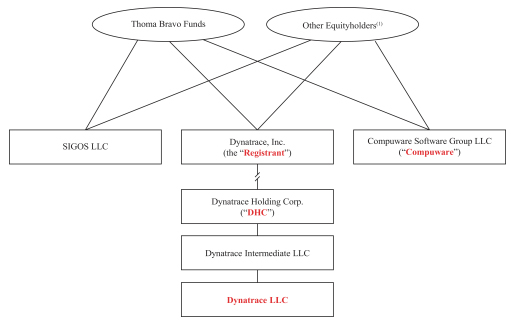

As a result of the Spin-Off Transactions and prior to the closing of this offering, (i) the Thoma Bravo Funds own approximately 80.7% of Dynatrace, Inc.s issued and outstanding common stock, (ii) DHC became a wholly owned indirect subsidiary of Dynatrace, Inc. and (iii) Dynatrace LLC became a wholly owned indirect subsidiary of DHC. Dynatrace, Inc. became the ultimate parent company of Dynatrace LLC and has no material assets or operations other than its direct and indirect ownership interests in its subsidiaries, including Dynatrace LLC. Additionally, Dynatrace, Inc. has several wholly owned direct subsidiaries that are legacies of the corporate structure that existed prior to this offering. Those entities hold no material assets or operations other than their ownership of a portion of the outstanding shares of DHC. See section titled Spin-Off Transactions.

The following diagram shows our organizational structure, and the ownership of Compuware and SIGOS, after giving effect to the Spin-Off Transactions.

| (1) | Includes employee equityholders and other equityholders who invested alongside the Thoma Bravo Funds. |

Emerging Growth Company

We are an emerging growth company within the meaning of the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from various public reporting requirements, including the requirement that we provide more than two years of audited financial statements and related managements discussion and analysis of financial condition and results of operations, that our internal control over financial reporting be audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, that we provide certain disclosures regarding executive compensation, and that we hold nonbinding stockholder advisory votes on executive compensation and any golden parachute payments not previously approved. We may take advantage of these exemptions until we are no longer an emerging growth company.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected

14

Table of Contents

to take advantage of the longer phase-in periods for the adoption of new or revised financial accounting standards under the JOBS Act until we are no longer an emerging growth company. Our election to use the phase-in periods permitted by this election may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the longer phase-in periods permitted under the JOBS Act and who will comply with new or revised financial accounting standards. If we were to subsequently elect instead to comply with public company effective dates, such election would be irrevocable pursuant to the JOBS Act.

We will remain an emerging growth company until the earliest to occur of (i) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (ii) the date on which we become a large accelerated filer (the fiscal year-end on which more than $700 million of equity securities are held by non-affiliates as of the last day of our then most recently completed second fiscal quarter (and we have been a public company for at least 12 months and have filed one annual report on Form 10-K)); (iii) the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year ending after the fifth anniversary of the completion of this offering.

Status as a Controlled Company

Assuming the sale by us of 34,000,000 shares of common stock in this offering, the Thoma Bravo Funds will initially own 199,668,920 shares of our common stock, representing approximately 70.9% of the voting power of our issued and outstanding capital stock following the completion of this offering (or 69.7% of our issued and outstanding shares of common stock if the underwriters option to purchase additional shares from us is exercised in full), and, as such, we will be a controlled company as of the completion of the offering under the Sarbanes-Oxley Act, and the rules of the New York Stock Exchange, or the NYSE. As a controlled company, a majority of our board of directors is not required to be independent, and we are not required to form independent compensation and nominating and corporate governance committees of our board of directors. As a controlled company, we will remain subject to rules of the Sarbanes-Oxley Act and the NYSE that require us to have an audit committee composed entirely of independent directors. Under these rules, we must have at least one independent director on our audit committee by the date our common stock is listed on the NYSE, at least two independent directors on our audit committee within 90 days of the listing date, and at least three directors, all of whom must be independent, on our audit committee within one year of the listing date. We expect to have six independent directors upon the closing of this offering, of whom two will qualify as independent for audit committee purposes.

If at any time we cease to be a controlled company, we will take all action necessary to comply with the Sarbanes-Oxley Act and rules of the NYSE, including by having a majority of independent directors and ensuring we have a compensation committee and a nominating and corporate governance committee, each composed entirely of independent directors, subject to a permitted phase-in period. See the section titled ManagementStatus as a Controlled Company.

15

Table of Contents

THE OFFERING

| Common stock offered by us |

34,000,000 shares. | |

| Common stock offered by the selling stockholders |

1,609,754 shares. |

|

| Option to purchase additional shares of common stock from us and the selling stockholders |

We and certain of the selling stockholders have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to 4,871,138 additional shares of common stock from us and up to 470,325 additional shares of common stock from the selling stockholders. |

|

| Common stock to be outstanding after this offering |

281,463,124 shares (286,334,262 shares if the underwriters option to purchase additional shares from us is exercised in full). |

|

| Use of proceeds |

We estimate that our net proceeds from the sale of shares of our common stock in this offering will be approximately $445.5 million (or approximately $510.0 million if the underwriters option to purchase additional shares from us is exercised in full), assuming an initial public offering price of $14.00 per share (the midpoint of the estimated price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use our net proceeds from this offering for general corporate purposes, including working capital, operating expenses and capital expenditures, and to repay a portion of the borrowings outstanding under our first and second lien term loan facilities, under which affiliates of certain of the underwriters in this offering are lenders. We will not receive any of the proceeds from the sale of the shares being offered by the selling stockholders. See section titled Use of Proceeds for additional information. |

|

| Indication of Interest |

One or more funds affiliated with Dragoneer Investment Group, LLC have indicated an interest in purchasing an aggregate of up to $75.0 million in shares of our common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, one or more funds affiliated with Dragoneer | |

16

Table of Contents

| Investment Group, LLC could determine to purchase more, less or no shares in this offering or the underwriters could determine to sell more, less or no shares to one or more funds affiliated with Dragoneer Investment Group, LLC. The underwriters will receive the same discount on any of our shares of common stock purchased by one or more funds affiliated with Dragoneer Investment Group, LLC as they will from any other shares of common stock sold to the public in this offering. | ||

| Controlled company |

After this offering, the Thoma Bravo Funds will own approximately 70.9% of our issued and outstanding shares of common stock, assuming the sale by us of 34,000,000 shares of common stock in this offering (or 69.7% of our issued and outstanding shares of common stock if the underwriters option to purchase additional shares from us is exercised in full). As a result, we expect to be a controlled company within the meaning of the corporate governance standards of the NYSE. See section titled ManagementStatus as a Controlled Company. | |

| Risk factors |

See section titled Risk Factors and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

| Proposed New York Stock Exchange symbol |

DT. | |

The number of shares of our common stock to be outstanding after this offering is based on 247,463,124 shares of common stock outstanding as of June 30, 2019, and includes:

| | 16,529,762 shares of our common stock issuable upon the exchange of equity awards that are issued, outstanding and vested as of June 30, 2019, which exchange occurred in connection with the Spin-Off Transactions; and |

| | 2,918,268 shares of restricted stock awards issuable upon the exchange of equity awards that are issued, outstanding and unvested as of June 30, 2019, which exchange occurred in connection with the Spin-Off Transactions. |

The number of shares of common stock to be outstanding after this offering excludes:

| | 1,236,972 shares of common stock issuable upon the vesting of restricted stock unit awards that are issuable upon the exchange of equity awards that are issued, outstanding and unvested as of June 30, 2019, which exchange occurred in connection with the Spin-Off Transactions; |

| | 52,000,000 shares of our common stock that will become available for future issuance under our 2019 Equity Incentive Plan, which will become effective prior to the effectiveness of the registration statement of which this prospectus is a part, under which we intend to grant (i) an aggregate of 20,685,002 shares of common stock, restricted stock awards and restricted stock |

17

Table of Contents

| unit awards, as described above, which are issuable upon conversion of equity grants in connection with the Spin-Off Transactions, as well as (ii) awards to certain of our directors, officers and employees totaling 2,703,486 restricted stock unit awards and 8,201,800 options to purchase shares of common stock at an exercise price equal to the initial public offering price set forth on the cover page of this prospectus, which awards will be effective immediately following the effectiveness of the registration statement of which this prospectus is a part; and |

| | 6,250,000 shares of our common stock that will become available for future issuance under our 2019 Employee Stock Purchase Plan, which will become effective prior to the effectiveness of the registration statement of which this prospectus is a part. |

Except as otherwise indicated, all information contained in this prospectus assumes or gives effect to:

| | the filing of our amended and restated certificate of incorporation, or charter, and the effectiveness of our amended and restated bylaws, or bylaws, upon the closing of this offering; |

| | the completion of the Spin-Off Transactions as if they had occurred on June 30, 2019, including the conversion of the outstanding units of Dynatrace Holdings LLC into shares of Dynatrace, Inc., at a fair value per unit of Dynatrace Holdings LLC determined by our board of directors, which is assumed to be $14.00 per unit, the midpoint of the estimated price range set forth on the cover page of this prospectus. |

| | no exercise by the underwriters of their option to purchase up to 4,871,138 additional shares of our common stock. |

The number of shares of our common stock outstanding following the completion of the Spin-Off Transactions will be based on the fair value of a unit of Dynatrace Holdings LLC, as determined by our board of directors (or committee thereof) immediately prior to the Spin-Off Transactions. In the event the fair value as of immediately prior to the completion of the Spin-Off Transactions is determined to be greater than, or less than, $14.00 per unit (the midpoint of the estimated price range set forth on the cover page of this prospectus), the number of shares of our common stock outstanding following completion of the Spin-Off Transactions would decrease or increase, respectively. At a fair value of $15.00 per unit, which is the high end of the estimated price range set forth on the cover page of this prospectus, the number of shares of our common stock outstanding following completion of the Spin-Off Transactions as if they had occurred on June 30, 2019 would decrease by 3,164,756 shares to 244,298,368. At a fair value of $13.00 per unit, which is the low end of the estimated price range set forth on the cover page of this prospectus, the number of shares of our common stock outstanding following completion of the Spin-Off Transactions as if they had occurred on June 30, 2019 would increase by 3,651,665 shares to 251,114,789.

18

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

You should read the following summary consolidated financial data together with our consolidated financial statements and the related notes appearing at the end of this prospectus and the Selected Consolidated Financial Data and Managements Discussion and Analysis of Financial Condition and Results of Operations sections of this prospectus. We have derived the consolidated statement of operations data for the years ended March 31, 2017, 2018 and 2019 from our audited consolidated financial statements appearing at the end of this prospectus. Our historical results are not necessarily indicative of results that may be expected in the future.

The following tables present selected consolidated financial data for the periods indicated.

| Year Ended March 31, | ||||||||||||

| 2017 | 2018 | 2019 | ||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||

| Revenue: |

||||||||||||

| Subscriptions |

$ | 232,783 | $ | 257,576 | $ | 349,830 | ||||||

| License |

130,738 | 98,756 | 40,354 | |||||||||

| Services |

42,856 | 41,715 | 40,782 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

406,377 | 398,047 | 430,966 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cost of revenues: |

||||||||||||

| Cost of subscriptions |

52,176 | 48,270 | 56,934 | |||||||||

| Cost of services |

30,735 | 30,316 | 31,529 | |||||||||

| Amortization of acquired technology |

19,261 | 17,948 | 18,338 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total cost of revenues(1) |

102,172 | 96,534 | 106,801 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross Profit |

304,205 | 301,513 | 324,165 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating expenses: |

||||||||||||

| Research and development(1) |

52,885 | 58,320 | 76,759 | |||||||||

| Sales and marketing(1) |

129,971 | 145,350 | 178,886 | |||||||||

| General and administrative(1) |

49,232 | 64,114 | 91,778 | |||||||||

| Amortization of other intangibles |

51,947 | 50,498 | 47,686 | |||||||||

| Restructuring and other |

7,637 | 4,990 | 1,763 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

291,672 | 323,272 | 396,872 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from operations |

12,533 | (21,759 | ) | (72,707 | ) | |||||||

| Other expense, net |

(28,926 | ) | (30,016 | ) | (67,204 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| (Loss) before taxes |

(16,393 | ) | (51,775 | ) | (139,911 | ) | ||||||

| Income tax benefit |

17,189 | 60,997 | 23,717 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 796 | $ | 9,222 | $ | (116,194 | ) | |||||

|

|

|

|

|

|

|

|||||||

| Net loss per share, basic and diluted (unaudited) which is subject to change(2) |

$ | (0.48 | ) | |||||||||

|

|

|

|||||||||||

| Weighted average shares used in computing net loss per share, basic and diluted (unaudited) which is subject to change(2) |

241,932,041 | |||||||||||

|

|

|

|||||||||||

19

Table of Contents

| (1) | The following table summarizes the classification of stock-based compensation expense in our consolidated statements of operations: |

| Year Ended March 31, | ||||||||||||

| 2017 | 2018 | 2019 | ||||||||||

| Cost of revenues |

$ | 28 | $ | 1,720 | $ | 5,777 | ||||||

| Research and development |

71 | 3,858 | 12,566 | |||||||||

| Sales and marketing |

122 | 7,536 | 24,673 | |||||||||

| General and administrative |

128 | 9,180 | 28,135 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total compensation expense |

$ | 349 | $ | 22,294 | $ | 71,151 | ||||||

|

|

|

|

|

|

|

|||||||

| (2) | Net loss per share has been calculated by giving retroactive effect to the conversion of equity in connection with the Spin-Off Transactions and is derived from the assumed initial public offering price of $14.00 per share (the midpoint of the estimated offering range set forth on the cover page of this prospectus). This amount is subject to change. |

| As of March 31, 2019 | ||||||||||||

| Actual | Pro Forma(2)(3) | Pro Forma as Adjusted(2)(4)(5) |

||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 51,314 | 51,314 | 109,892 | ||||||||

| Working capital, excluding deferred revenue(1) |

132,239 | 132,239 | 190,817 | |||||||||

| Total assets |

1,811,366 | 1,811,366 | 1,869,944 | |||||||||

| Deferred revenue, current and non-current portion |

365,745 | 365,745 | 365,745 | |||||||||

| Long-term debt, net of current portion |

1,011,793 | 1,011,793 | 628,558 | |||||||||

| Total liabilities |

2,201,624 | 1,512,427 | 1,129,192 | |||||||||

| Total stockholders equity (deficit) |

(390,258 | ) | 298,939 | 740,752 | ||||||||

| (1) | We define working capital as current assets less current liabilities, excluding related-party payables. |

| (2) | The pro forma and pro forma as adjusted cash and cash equivalents does not reflect the $265.0 million that Compuware distributed to us to partially satisfy the estimated $275.0 million tax liability incurred by us in connection with the Compuware Spin-Off. We expect to fund the remaining portion of the tax liability with cash flow from operations. Of the total tax liability, we expect to pay approximately $265.0 million to the applicable taxing authorities during the three months ending September 30, 2019, and the balance will be due by no later than March 2020. |

| (3) | Gives effect to the completion of the Spin-Off Transactions, as set forth under the section titled Spin-Off Transactions, including the elimination of the related party payable and the reclassification of our share-based compensation liability to additional paid-in capital on July 31, 2019. |

| (4) | Gives effect to the pro forma adjustments set forth above and the sale and issuance by us of 34,000,000 shares of our common stock in this offering, assuming an initial public offering price of $14.00 per share (the midpoint of the estimated offering price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and the application of our net proceeds from this offering, including the repayment of $386.0 million of borrowings outstanding under our credit facility, as set forth under the section titled Use of Proceeds. |

| (5) | Each $1.00 increase (decrease) in the assumed initial public offering price of $14.00 per share (the midpoint of the estimated offering price range set forth on the cover page of this prospectus), would increase (decrease) the pro forma as adjusted amount of cash and cash equivalents, working capital excluding deferred revenue, total assets and total stockholders equity by |

20

Table of Contents