EX-10.12

Published on July 5, 2019

Exhibit 10.12

RESERVOIR PLACE MAIN

WALTHAM, MASSACHUSETTS

Lease Dated July 6, 2017

THIS INSTRUMENT IS AN INDENTURE OF LEASE in which Landlord and Tenant are the parties hereinafter named, and which relates to space in a certain building (the Building) known as Reservoir Place Main and with an address at 1601 Trapelo Road, Waltham, Massachusetts 02451.

The parties to this Indenture of Lease hereby agree with each other as follows:

ARTICLE 1

Reference Data

| 1.1 | Subjects Referred To |

Each reference in this Lease to any of the following subjects shall be construed to incorporate the data stated for that subject in this Article:

| Landlord: | BP RESERVOIR PLACE LLC, a Delaware limited liability company | |

| Landlords Original Address: | c/o Boston Properties Limited Partnership Prudential Center 800 Boylston Street, Suite 1900 Boston, Massachusetts 02199-8103 |

|

| Tenant: | DYNATRACE LLC, a Delaware limited liability company | |

| Tenants Original Address: | 404 Wyman Street Waltham, Massachusetts 02451 |

|

| Tenants Email Address for Information Regarding Billings and Statements: | *** | |

| Landlords Construction Representative: | Ken Chianca | |

| Tenants Construction Representative: | Lynne Rosenberg | |

| Tenant Plans Date: | August 1, 2017 | |

Page 1

| Delivery Date: | July 16, 2017. Landlord shall deliver the Premises to Tenant on the Delivery Date, (i) free and clear of (a) all tenants and occupants and (b) any debris and personal property (other than wiring and cabling) and (ii) in broom-clean condition. | |

| Commencement Date: | As defined in Section 2.4 of this Lease and in Exhibit B-1. | |

| Rent Commencement Date: | January 1, 2018 | |

| Term or Lease Term (sometimes called the Original Term): | The one-hundred twenty-two (122) month period plus any partial month beginning on the Delivery Date and ending on the Expiration Date (as hereinafter defined), unless extended or sooner terminated as hereinafter provided. | |

| Expiration Date: | September 30, 2027 | |

| Extension Option: | One (1) period of seven (7) years, as provided in and on the terms set forth in Section 9.18 hereof. | |

| The Site: | That certain parcel of land located on Trapelo Road, Waltham, Middlesex County, Massachusetts, being more particularly described in Exhibit A attached hereto | |

| The Building: | The Building known as Reservoir Place Main, and numbered 1601 Trapelo Road, Waltham, Massachusetts, located on the Site and containing the Total Rentable Floor Area set forth below. | |

| The Additional Building: | The other building known as Reservoir Place South located on the Site and containing the Total Rentable Floor Area set forth below. | |

| The Buildings: | The Building and the Additional Building. | |

| The Complex: | The Building and the Additional Building together with all common areas, parking areas, garage, and structures and the Site. | |

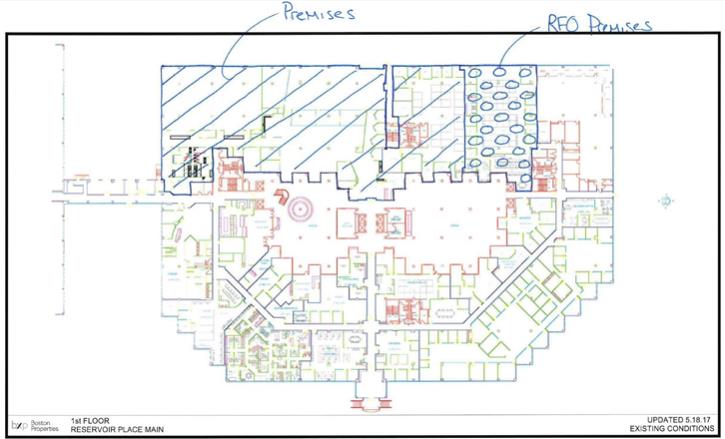

| Tenants Premises: | A portion of the first (1st) floor of the Building shown as Premises on the floor plan annexed hereto as Exhibit D and incorporated herein by reference. | |

Page 2

| Number of Parking Privileges: | Privileges for parking one hundred forty one (141) automobiles, forty one (41) of which are located in the garage below the Building, and one hundred (100) of which will be located on the outdoor surface lot. | |

| Annual Fixed Rent: | (a) During the Original Term of this Lease, Annual Fixed Rent shall be payable by Tenant as follows: | |

| Time Period |

Rate PSF | Annual Rate | ||

| Delivery Date December 31, 2017 |

$0.00* | $0.00* | ||

| January 1, 2018 September 30, 2019 |

$22.35 | $902,716.50^ | ||

| October 1, 2019 September 30, 2020 |

$26.37 | $1,065,084.30 | ||

| October 1, 2020 September 30, 2021 |

$27.12 | $1,095,376.80 | ||

| October 1, 2021 September 30, 2022 |

$27.87 | $1,125,669.30 | ||

| October 1, 2022 September 30, 2027 |

$40.50 | $1,635,795.00^ |

| * Tenant shall have no obligation to pay Annual Fixed Rent for the period commencing as of the Delivery Date, and expiring as of the day before the Rent Commencement Date (the Rent Abatement Period). During the Rent Abatement Period, only Annual Fixed Rent, Operating Expenses Allocable to the Premises and Landlords Tax Expenses Allocable to the Premises shall be abated, and all other Additional Rent for the Premises shall remain as due and payable pursuant to the provisions of the Lease.

^ Annualized.

(b) During the Extended Term (if Tenant exercised its Extension Option), as determined pursuant to Section 9.18. |

||

| Base Operating Expenses: | Landlords Operating Expenses (as hereinafter defined in Section 2.6) for calendar year 2018, being January 1, 2018 through December 31, 2018. | |

| Base Taxes: | Landlords Tax Expenses (as hereinafter defined in Section 2.7) for fiscal tax year 2018, being July 1, 2017 through June 30, 2018. | |

Page 3

| Tenant Electricity: | As provided in Section 2.8 | |

| Rentable Floor Area of the Premises: | 40,390 square feet. | |

| Total Rentable Floor Area of the Building: | 368,257 square feet. | |

| Total Rentable Floor Area of the Additional Building: | 161,734 square feet. | |

| Total Rentable Floor Area of the Buildings: | 529,991 square feet. | |

| Permitted Use: | General office purposes. | |

| Brokers: | Transwestern RBJ | |

| Security Deposit: | $408,000 | |

| 1.2 | Table of Articles and Sections |

| ARTICLE 1 REFERENCE DATA |

1 | |||

| 1.1 Subjects Referred To |

1 | |||

| 1.2 Table of Articles and Sections |

4 | |||

| 1.3 Exhibits |

6 | |||

| ARTICLE 2 BUILDING, PREMISES, TERM AND RENT |

7 | |||

| 2.1 The Premises |

7 | |||

| 2.2 Rights to Use Common Facilities |

7 | |||

| 2.3 Landlords Reservations |

8 | |||

| 2.4 Habendum |

8 | |||

| 2.5 Fixed Rent Payments |

9 | |||

| 2.6 Operating Expenses |

10 | |||

| 2.7 Real Estate Taxes |

16 | |||

| 2.8 Tenant Electricity |

18 | |||

| ARTICLE 3 CONDITION OF PREMISES |

20 | |||

| 3.1 Preparation of Premises |

20 | |||

| ARTICLE 4 LANDLORDS COVENANTS; INTERRUPTIONS AND DELAYS |

20 | |||

| 4.1 Landlord Covenants |

20 | |||

| 4.2 Interruptions and Delays in Services and Repairs, Etc. |

22 | |||

| 4.3 Payment of Litigation Expenses |

23 | |||

Page 4

| ARTICLE 5 TENANTS COVENANTS |

23 | |||

| 5.1 Payments |

23 | |||

| 5.2 Repair and Yield Up |

23 | |||

| 5.3 Use |

24 | |||

| 5.4 Obstructions; Items Visible From Exterior; Rules and Regulations |

25 | |||

| 5.5 Safety Appliances; Licenses |

26 | |||

| 5.6 Assignment; Sublease |

26 | |||

| 5.7 Right of Entry |

33 | |||

| 5.8 Floor Load; Prevention of Vibration and Noise |

34 | |||

| 5.9 Personal Property Taxes |

34 | |||

| 5.10 Compliance with Laws |

34 | |||

| 5.11 Payment of Litigation Expenses |

35 | |||

| 5.12 Alterations |

35 | |||

| 5.13 Vendors |

37 | |||

| 5.14 OFAC |

37 | |||

| ARTICLE 6 CASUALTY AND TAKING |

37 | |||

| 6.1 Damage Resulting From Casualty |

37 | |||

| 6.2 Uninsured Casualty |

39 | |||

| 6.3 Rights of Termination for Taking |

40 | |||

| 6.4 Award |

40 | |||

| ARTICLE 7 DEFAULT |

41 | |||

| 7.1 Tenants Default |

41 | |||

| 7.2 Landlords Default |

45 | |||

| ARTICLE 8 INSURANCE AND INDEMNITY |

45 | |||

| 8.1 Tenants Indemnity |

45 | |||

| 8.2 Tenants Risk |

47 | |||

| 8.3 Tenants Commercial General Liability Insurance |

47 | |||

| 8.4 Tenants Property Insurance |

48 | |||

| 8.5 Tenants Other Insurance |

49 | |||

| 8.6 Requirements for Tenants Insurance |

49 | |||

| 8.7 Additional Insureds |

50 | |||

| 8.8 Certificates of Insurance |

50 | |||

| 8.9 Subtenants and Other Occupants |

50 | |||

| 8.10 No Violation of Building Policies |

51 | |||

| 8.11 Tenant to Pay Premium Increases |

51 | |||

| 8.12 Landlords Insurance |

51 | |||

| 8.13 Waiver of Subrogation |

52 | |||

| 8.14 Tenants Work |

52 | |||

| ARTICLE 9 MISCELLANEOUS PROVISIONS |

53 | |||

| 9.1 Waiver |

53 | |||

| 9.2 Cumulative Remedies |

53 | |||

| 9.3 Quiet Enjoyment |

54 | |||

| 9.4 Notice to Mortgagee and Ground Lessor |

55 | |||

Page 5

| 9.5 Assignment of Rents |

55 | |||

| 9.6 Surrender |

56 | |||

| 9.7 Brokerage |

57 | |||

| 9.8 Invalidity of Particular Provisions |

57 | |||

| 9.9 Provisions Binding, Etc. |

57 | |||

| 9.10 Recording; Confidentiality |

57 | |||

| 9.11 Notices |

58 | |||

| 9.12 When Lease Becomes Binding and Authority |

59 | |||

| 9.13 Section Headings |

59 | |||

| 9.14 Rights of Mortgagee |

59 | |||

| 9.15 Status Reports and Financial Statements |

60 | |||

| 9.16 Self-Help |

60 | |||

| 9.17 Holding Over |

61 | |||

| 9.18 Extension Option |

61 | |||

| 9.19 Security Deposit |

62 | |||

| 9.20 Late Payment |

63 | |||

| 9.21 Additional Rent |

64 | |||

| 9.22 Waiver of Trial by Jury |

64 | |||

| 9.23 Electronic Signatures |

65 | |||

| 9.24 Governing Law |

65 | |||

| 9.25 Right of First Offer |

65 | |||

| 9.26 Fitness Center |

67 | |||

| 9.27 Cafeteria |

67 |

| 1.3 | Exhibits |

There are incorporated as part of this Lease:

| Exhibit A | | Description of Site | ||

| Exhibit B-1 | | Work Agreement | ||

| Exhibit B-2 | | Tenant Plan and Working Drawing Requirements | ||

| Exhibit B-3 | | Tenants Schematic Plans | ||

| Exhibit C | | Landlords Services | ||

| Exhibit D | | Floor Plan of Premises and RFO Premises | ||

| Exhibit E | | Form of Declaration Affixing the Commencement Date of Lease | ||

| Exhibit F | | Form of Lien Waivers | ||

| Exhibit G | | List of Mortgages | ||

Page 6

| Exhibit H | | Brokers Determination of Prevailing Market Rate | ||

| Exhibit I-1 | | Building Signage | ||

| Exhibit I-2 | | Restricted Signage Area | ||

| Exhibit J | | Form of Certificate of Insurance | ||

ARTICLE 2

Building, Premises, Term and Rent

| 2.1 | The Premises |

Landlord hereby demises and leases to Tenant, and Tenant hereby hires and accepts from Landlord, Tenants Premises in the Building excluding exterior faces of exterior walls, the common stairways and stairwells, elevators and elevator wells, fan rooms, electric and telephone closets, janitor closets, freight elevator vestibules, and pipes, ducts, conduits, wires and appurtenant fixtures serving exclusively or in common other parts of the Building and if Tenants Premises includes less than the entire rentable area of any floor, excluding the common corridors, elevator lobbies and toilets located on such floor.

Tenants Premises with such exclusions is hereinafter sometimes referred to as the Premises. The term Building means the Building identified on the first page, and which is the subject of this Lease and being one of the two (2) Buildings erected on the Site by Landlord; the term Site means all, and also any part, of the Land described in Exhibit A, plus any additions or reductions thereto resulting from the change of any abutting street line and all parking areas and structures. The terms Property or Complex means the two (2) Buildings and the Site.

| 2.2 | Rights to Use Common Facilities |

Subject to Landlords right to change or alter any of the following in Landlords discretion as herein provided, Tenant shall have, as appurtenant to the Premises, the non-exclusive right to use in common with others, but not in a manner or extent that would materially interfere with the normal operation and use of the Building as a multi-tenant office building and subject to reasonable rules of general applicability to tenants of the Building from time to time made by Landlord of which Tenant is given notice: (a) the common lobbies, corridors, stairways, and elevators of the Building, and the pipes, ducts, shafts, conduits, wires and appurtenant meters and equipment serving the Premises in common with others, (b) the loading areas serving the Building and the common walkways and driveways necessary for access to the Building, and (c) if the Premises include less than the entire rentable floor area of any floor, the common toilets, corridors and elevator lobby of such floor. Notwithstanding anything to the contrary herein, Landlord has no obligation to allow any particular telecommunication service provider to have access to the Building or the Premises. If Landlord permits such access, Landlord may condition such access upon the payment to Landlord by the service provider of fees assessed by Landlord in its sole discretion.

Page 7

| 2.2.1 | Tenants Parking |

In addition, Landlord shall provide to Tenant for Tenants use during the Term, at no additional charge, the number of parking privileges specified in Section 1.1 for the parking of automobiles, in common with use by other tenants from time to time of the Complex, and on a first-come, first-served basis, and Landlord shall not be obligated to furnish stalls or spaces on the Site specifically designated for Tenants use. In the event that the Rentable Floor Area of the Premises increases or decreases at any time during the Lease Term, the Number of Parking Spaces provided to Tenant hereunder shall be increased or reduced proportionately. Tenant covenants and agrees that it and all persons claiming by, through and under it, shall at all times abide by all reasonable rules and regulations promulgated by Landlord with respect to the use of the parking areas on the Site. The parking privileges granted herein are non-transferable except to a permitted assignee or subtenant as provided in Section 5.6. Further, Landlord assumes no responsibility whatsoever for loss or damage due to fire, theft or otherwise to any automobile(s) parked on the Site or to any personal property therein, however caused, and Tenant covenants and agrees, upon request from Landlord from time to time, to notify its officers, employees, agents and invitees of such limitation of liability. Tenant acknowledges and agrees that a license only is hereby granted, and no bailment is intended or shall be created.

| 2.3 | Landlords Reservations |

Landlord reserves the right from time to time, without unreasonable interference with Tenants use: (a) to install, use, maintain, repair, replace and relocate for service to the Premises and other parts of the Building, or either, pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises or Building, and (b) to alter or relocate any other common facility, provided that substitutions are substantially equivalent or better. Installations, replacements and relocations referred to in clause (a) above shall be located so far as practicable in the central core area of the Building, above ceiling surfaces, below floor surfaces or within perimeter walls of the Premises. Except in the case of emergencies or for normal cleaning and maintenance operations, Landlord agrees to use its best efforts to give Tenant reasonable advance notice of any of the foregoing activities which require work in the Premises.

| 2.4 | Habendum |

The Term of this Lease shall be the period specified in Section 1.1 hereof as the Lease Term, unless sooner terminated or extended as herein provided. The Lease Term hereof shall commence on the Delivery Date. The Commencement Date shall be the first to occur of:

(a) November 1, 2017; or

Page 8

(b) The date upon which Tenant first occupies all or a portion of the Premises for the Permitted Use.

Tenant shall, in all events, be treated as having commenced beneficial use of the Premises when it begins its regular business operations. In the case where the Premises are to be delivered in their as-is condition, the day on which the Premises are delivered by Landlord to Tenant shall be the date on which Landlord delivers the Premises to Tenant free and clear of all other tenants and occupants, and free of all debris and personal property.

Landlord shall cause all Building systems serving the Premises and the Common Areas of the Building to be in good working order and repair on the Delivery Date. Landlord hereby represents to Tenant that, as of the execution date of this Lease, Landlord has not received written notices from any governmental agencies that the Building or Premises are in violation of any applicable laws, regulations, bylaws or building codes, the subject of which remains uncured.

As soon as may be convenient after the Commencement Date has been determined, Landlord and Tenant agree to join with each other in the execution, in the form of Exhibit E hereto, of a written Declaration Affixing the Commencement Date of Lease in which the Commencement Date and specified Lease Term of this Lease shall be stated. If Tenant shall fail to execute such Declaration Affixing the Commencement Date of Lease, the Commencement Date and Lease Term shall be as reasonably determined by Landlord in accordance with the terms of this Lease.

| 2.5 | Fixed Rent Payments |

Until notice of some other designation is given, fixed rent and all other charges for which provision is herein made shall be paid by remittance to or for the order of Boston Properties Limited Partnership either (i) by ACH transfer to Bank of America in Dallas, Texas, Bank Routing Number *** or (ii) by mail to P.O. Box 3557, Boston, Massachusetts 02241-3557, and in the case of (i) referencing Account Number ***, Account Name of ***, Tenants name and the Property address, 1 (a) on the Rent Commencement Date (defined in Section 1.1 hereof) and thereafter monthly, in advance, on the first day of each and every calendar month during the Original Term, a sum equal to one twelfth (1/12th) of the Annual Fixed Rent (sometimes hereinafter referred to as fixed rent) and 1 (b) on the Commencement Date and thereafter monthly, in advance, on the first day of each and every calendar month during the Original Term, an amount estimated by Landlord from time to time to cover Tenants monthly payments for electricity under Section 2.8 and (2) on the first day of each and every calendar month during each extension option period (if exercised), a sum equal to (a) one twelfth (1/12th) of the Annual Fixed Rent as determined in Section 9.18 for the extension option period plus (b) then applicable monthly electricity charges (subject to escalation for electricity as provided in Section 2.8 hereof).

Annual Fixed Rent for any partial month shall be paid by Tenant to Landlord at such rate on a pro rata basis.

Page 9

Additional Rent payable by Tenant on a monthly basis, as elsewhere provided in this Lease, likewise shall be prorated, and the first payment on account thereof shall be determined in similar fashion and shall commence on the Commencement Date and other provisions of this Lease calling for monthly payments shall be read as incorporating this undertaking by Tenant.

Notwithstanding that the payment of Annual Fixed Rent payable by Tenant to Landlord shall not commence until the Rent Commencement Date, Tenant shall be subject to, and shall comply with, all other provisions of this Lease as and at the times provided in this Lease.

The Annual Fixed Rent and all other charges for which provision is herein made shall be paid by Tenant to Landlord, without offset, deduction or abatement except as otherwise specifically set forth in this Lease.

| 2.6 | Operating Expenses |

Landlords Operating Expenses means the cost of operation of the Buildings and the Site which shall exclude costs of special services rendered to tenants (including Tenant) for which a separate charge is made, but shall include, without limitation, the following: premiums for insurance carried with respect to the Buildings and the Site (including, without limitation, liability insurance, insurance against loss in case of fire or casualty and insurance of monthly installments of fixed rent and any additional rent which may be due under this Lease and other leases of space in the Buildings for not more than 12 months in the case of both fixed rent and additional rent and if there be any first mortgage of the Property, including such insurance as may be required by the holder of such first mortgage); compensation and all fringe benefits, workmens compensation insurance premiums and payroll taxes paid to, for or with respect to all persons engaged in the operating, maintaining, managing, insuring or cleaning of the Buildings or Site, water, sewer, electric (to the extent not payable pursuant to Section 2.8), gas, oil and telephone charges (excluding heating, ventilating and air conditioning, electricity and utility charges separately chargeable to tenants); cost of building and cleaning supplies and equipment; cost of maintenance, cleaning and repairs (other than repairs not properly chargeable against income or reimbursed from contractors under guarantees); cost of snow removal and care of landscaping; payments under service contracts with independent contractors; payments by Landlord to the town in which the Complex is located relating to traffic safety, fire safety, and other governmental services and programs; management fees at reasonable rates for self managed buildings consistent with the type of occupancy and the service rendered; costs of maintaining a regional property management office in connection with the operation, management and maintenance of the Building; all costs of applying and reporting for the Building or any part thereof to seek or maintain certification under the U.S. EPAs Energy Star® rating system, the U.S. Green Building Councils Leadership in Energy and Environmental Design (LEED) rating system or a similar system or standard; and all other reasonable and necessary expenses paid in connection with the operation, cleaning, management, insuring and maintenance of the Buildings and the Site and properly chargeable against income; provided, however, there

Page 10

shall be included (a) depreciation for capital expenditures made by Landlord during the Lease Term (i) to reduce operating expenses if Landlord shall have reasonably determined that the annual reduction in operating expenses shall exceed depreciation therefor or (ii) to comply with applicable laws, rules, regulations, requirements, statutes, ordinances, by-laws and court decisions of all public authorities enacted or first applicable to the Complex after the date of this Lease (the capital expenditures described in subsections (i) and (ii) being hereinafter referred to as Permitted Capital Expenditures); plus (b) in the case of both (i) and (ii) an interest factor, reasonably determined by Landlord, as being the interest rate then charged for long term mortgages by institutional lenders on like properties within the locality in which the Buildings is located; depreciation in the case of both (i) and (ii) shall be determined by dividing the original cost of such capital expenditure by the number of years of useful life of the capital item acquired and the useful life shall be reasonably determined by Landlord in accordance with generally accepted accounting principles and practices in effect at the time of acquisition of the capital item; and further provided, however, if Landlord reasonably concludes on the basis of engineering estimates that a particular capital expenditure will effect savings in other Landlords Operating expenses, including, without limitation, energy related costs, and that such projected savings will, on an annual basis (Projected Annual Savings), exceed the annual depreciation therefor, then and in such event the amount of depreciation for such capital expenditure shall be increased to an amount equal to the Projected Annual Savings; and in such circumstance, the increased depreciation (in the amount of the Projected Annual Savings) shall be made for such period of time as it would take to fully amortize the cost of the item in question, together with interest thereon at the interest rate as aforesaid in equal monthly payments, each in the amount of 1/12th of the Projected Annual Savings, with such payment to be applied first to interest and the balance to principal.

Notwithstanding the foregoing, the following shall not be included within Landlords Operating Expenses:

| (i) | capital improvements to the Property other than Permitted Capital Expenditures; |

| (ii) | costs in constructing any additional buildings or improvements on the site; |

| (iii) | depreciation for the Building; |

| (iv) | principal or interest on indebtedness, debt amortization or ground rent paid by Landlord in connection with any mortgages, deeds of trust or other financing encumbrances, or ground leases of the Building or the Site; |

| (v) | legal fees, space planners fees, architects fees, leasing and brokerage commissions, advertising and promotional expenditures and any other marketing expense incurred in connection with the leasing of space in the Building (including new leases, lease amendments, lease terminations and lease renewals); |

Page 11

| (vi) | expenditures for any leasehold improvement which is made in connection with the preparation of any portion of the Building for occupancy by any tenant or which is not made generally to or for the benefit of the Building or the Site; |

| (vii) | fees, costs and expenses incurred by Landlord in connection with or relating to claims against or disputes with tenants of the Building; |

| (viii) | the cost of any items to the extent to which such cost is reimbursed to Landlord by tenants of the Property (other than pursuant to this Section 2.6), or other third parties, or is covered by a warranty to the extent of reimbursement for such coverage; |

| (ix) | any increase in the cost of Landlords insurance expressly stated to be caused by a specific use of another tenant or by Landlord; |

| (x) | attorneys fees, costs and disbursements, arbitration costs, damages, penalties and other expenses incurred in connection with negotiations or disputes with tenants, other occupants, or prospective tenants or occupants; |

| (xi) | any fines or penalties incurred due to (a) violations by Landlord of any governmental rule or regulation, or (b) the gross negligence or willful misconduct of the Landlord or its agents, contractors, or employees; |

| (xii) | except as may be otherwise expressly provided in this Lease with respect to specific items, the cost of any services or materials provided by any party related to Landlord, to the extent such cost exceeds, the reasonable cost for such services or materials absent such relationship in self-managed buildings similar to the Building in the vicinity of the Building; |

| (xiii) | replacement or contingency reserves or any bad debt loss, rent loss or reserves for bad debts or rent loss; |

| (xiv) | the wages and benefits of any employee who does not devote substantially all of his or her employed time to the Property unless such wages and benefits are prorated on a reasonable basis to reflect time spent on the operation and management of the Property vis-à-vis time spent on matters unrelated to the operation and management of the Property; |

Page 12

| (xv) | salaries and all other compensation (including fringe benefits) of partners, officers and executives above the grade of building manager; |

| (xvi) | costs and expenses incurred for the administration of the entity which constitutes Landlord, as the same are distinguished from the costs of operation, management, maintenance and repair of the Property, including, without limitation, entity accounting and legal matters; |

| (xvii) | the cost of remediation and removal of Hazardous Materials (as that term is defined in Section 5.3 below) in the Building or on the Site required by Hazardous Materials Laws (as that term is defined in Section 5.3 below), provided, however, that the provisions of this clause xvii shall not preclude the inclusion of costs with respect to materials (whether existing at the Property as of the date of this Lease or subsequently introduced to the Property) which are not as of the date of this Lease (or as of the date of introduction) deemed to be Hazardous Materials under applicable Hazardous Materials Laws but which are subsequently deemed to be Hazardous Materials under applicable Hazardous Materials Laws (it being understood and agreed that Tenant shall nonetheless be responsible under Section 5.3 of this Lease for all costs of remediation and removal of Hazardous Materials to the extent caused by Tenant Parties; and |

| (xviii) | the cost of acquiring sculptures, paintings or other objects of fine art in the Building in excess of amounts typically spent for such items in Class A office buildings of comparable quality in the competitive area of the Building. |

Operating Expenses Allocable to the Premises shall mean (a) the same proportion of Landlords Operating Expenses for and pertaining to the Buildings as the Rentable Floor Area of the Premises bears to 95% of the Total Rentable Floor Area of the Buildings plus (b) the same proportion of Landlords Operating Expenses for and pertaining to the Site as the Rentable Floor Area of the Premises bears to 95% of the Total Rentable Floor Area of the Buildings.

Base Operating Expenses is hereinbefore defined in Section 1.1. Base Operating Expenses shall not include (i) market-wide cost increases due to extraordinary circumstances, including but not limited to, Force Majeure (as defined in Section 6.1), boycotts, strikes, conservation surcharges, security concerns, embargoes or shortages and (ii) the amount of any Discontinued Permitted Capital Expenditures. As used herein, Discontinued Permitted Capital Expenditures shall mean the following: if Landlords Operating Expenses for calendar year 2018 include the amortized amount of

Page 13

one or more Permitted Capital Expenditures, then each such Permitted Capital Expenditure shall be included in Base Operating Expenses only for ensuing calendar years where Landlords Operating Expenses also include the amortized amount of such Permitted Capital Expenditures, but once Landlords Operating Expenses no longer include the amortized amount of such Permitted Capital Expenditure, the amortized amount of such Permitted Capital Expenditure that was included in Landlords Operating Expenses for calendar year 2018 shall be deemed to be a Discontinued Permitted Capital Expenditure and shall be excluded from Base Operating Expenses.

Base Operating Expenses Allocable to the Premises means (i) the same proportion of Base Operating Expenses for and pertaining to the Buildings as the Rentable Floor Area of the Premises bears to 95% of the Rentable Floor Area of the Buildings plus (ii) the same proportion of Base Operating Expenses for and pertaining to the Site as the Rentable Floor Area of the Premises bears to 95% of the Rentable Floor Area of the Buildings.

If with respect to any calendar year falling within the Term, or fraction of a calendar year falling within the Term at the beginning or end thereof, the Operating Expenses Allocable to the Premises for a full calendar year exceed Base Operating Expenses Allocable to the Premises, or for any such fraction of a calendar year exceed the corresponding fraction of Base Operating Expenses Allocable to the Premises, then Tenant shall pay to Landlord, as Additional Rent, the amount of such excess. Such payments shall be made at the times and in the manner hereinafter provided in this Section 2.6. The Base Operating Expenses Allocable to the Premises do not include any costs in respect of electricity and HVAC, provision for the payment of which is made in Section 2.8 of this Lease.

Not later than one hundred twenty (120) days after the end of the first calendar year or fraction thereof ending December 31 and of each succeeding calendar year during the Term or fraction thereof at the end of the Term (each an Operating Year), Landlord shall render Tenant a statement in reasonable detail and according to usual accounting practices certified by a representative of Landlord, showing for the preceding calendar year or fraction thereof, as the case may be, Landlords Operating Expenses and Operating Expenses Allocable to the Premises. Said statement to be rendered to Tenant shall also show for the preceding year or fraction thereof as the case may be the amounts of operating expenses already paid by Tenant as additional rent, and the amount of operating expenses remaining due from, or overpaid by, Tenant for the year or other period covered by the statement. Within thirty (30) days after the date of delivery of such statement, Tenant shall pay to Landlord the balance of the amounts, if any, required to be paid pursuant to the above provisions of this Section 2.6 with respect to the preceding year or fraction thereof, or Landlord shall credit any amounts due from it to Tenant pursuant to the above provisions of this Section 2.6 against (i) monthly installments of fixed rent next thereafter coming due or (ii) any sums then due from Tenant to Landlord under this Lease (or refund such portion of the overpayment as aforesaid if the Term has ended and Tenant has no further obligation to Landlord).

Page 14

In addition, Tenant shall make payments monthly on account of Tenants share of increases in Landlords Operating Expenses anticipated for the then current year at the time and in the fashion herein provided for the payment of Annual Fixed Rent. The amount to be paid to Landlord shall be an amount reasonably estimated annually by Landlord to be sufficient to cover, in the aggregate, a sum equal to Tenants share of such increases in Landlords Operating Expenses for each calendar year during the Term.

Notwithstanding the foregoing, in determining the amount of Landlords Operating Expenses for any calendar year or portion thereof falling within the Lease Term, if less than ninety-five percent (95%) of the Total Rentable Floor Area of the Building shall have been occupied by tenants at any time during the period in question, then, at Landlords election, those components of Landlords Operating Expenses that vary based on occupancy for such period shall be adjusted to equal the amount such components of Landlords Operating Expenses would have been for such period had occupancy been ninety-five percent (95%) throughout such period.

Subject to the provisions of this Section and provided that no monetary Event of Default of Tenant exists, Tenant shall have the right to examine the correctness of the Landlords Operating Expenses statement or any item contained therein:

| 1. | Any request for examination in respect of any Operating Year may be made by notice from Tenant to Landlord no more than sixty (60) days after the date (the Operating Expense Statement Date) Landlord provides Tenant a statement of the actual amount of the Landlords Operating Expenses in respect of such Operating Year and only if Tenant shall have fully paid such amount. Such notice shall set forth in reasonable detail the matters questioned. Any examination must be completed and the results communicated to Landlord no more than one hundred eighty (180) days after the Operating Expense Statement Date. |

| 2. | Tenant hereby acknowledges and agrees that Tenants sole right to contest the Operating Expenses statement shall be as expressly set forth in this Section. Tenant hereby waives any and all other rights provided pursuant to applicable laws to inspect Landlords books and records and/or to contest the Operating Expenses statement. If Tenant shall fail to timely exercise Tenants right to inspect Landlords books and records as provided in this Section, or if Tenant shall fail to timely communicate to Landlord the results of Tenants examination as provided in this Section, with respect to any Operating Year Landlords statement of Landlords Operating Expenses shall be conclusive and binding on Tenant for the particular year in question. |

| 3. | So much of Landlords books and records pertaining to the Landlords Operating Expenses for the specific matters questioned by Tenant for the Operating Year included in Landlords statement shall be made available to Tenant within a reasonable time after Landlord timely receives the notice from Tenant to make such examination pursuant to this Section, either electronically or during normal business hours at the offices where Landlord keeps such books and records or at another location, as determined by Landlord. |

Page 15

| 4. | Tenant shall have the right to make such examination no more than once in respect of any Operating Year in which Landlord has given Tenant a statement of the Landlords Operating Expenses. |

| 5. | Such examination may be made only by a qualified employee of Tenant or a qualified independent certified public accounting firm reasonably approved by Landlord. No examination shall be conducted by an examiner who is to be compensated, in whole or in part, on a contingent fee basis. |

| 6. | As a condition to performing any such examination, Tenant and its examiners shall be required to execute and deliver to Landlord an agreement, in form acceptable to Landlord, agreeing to keep confidential any information which it discovers about Landlord or the Building in connection with such examination. |

| 7. | No subtenant shall have any right to conduct any such examination and no assignee may conduct any such examination with respect to any period during which the assignee was not in possession of the Premises. |

| 8. | All costs and expenses of any such examination shall be paid by Tenant, except if such examination shows that the amount of the Landlords Operating Expenses payable by Tenant was overstated by more than five percent (5%), Landlord shall reimburse Tenant for the reasonable out-of-pocket costs and expenses incurred by Tenant in such examination, up to a maximum of the lesser of (i) Three-Thousand Dollars ($3,000) and (ii) the amount of the overstatement of the Landlords Operating Expenses payable by tenant. |

| 9. | If as a result of such examination Landlord and Tenant agree that the amounts paid by Tenant to Landlord on account of the Landlords Operating Expenses exceeded the amounts to which Landlord was entitled hereunder, or that Tenant is entitled to a credit with respect to the Landlords Operating Expenses, Landlord, at its option, shall refund to Tenant the amount of such excess or apply the amount of such credit, as the case may be, within thirty (30) days after the date of such agreement. Similarly, if Landlord and Tenant agree that the amounts paid by Tenant to Landlord on account of Landlords Operating Expenses were less than the amounts to which Landlord was entitled hereunder, then Tenant shall pay to Landlord, as additional rent hereunder, the amount of such deficiency within thirty (30) days after the date of such agreement. |

| 2.7 | Real Estate Taxes |

If with respect to any full Tax Year or fraction of a Tax Year falling within the Term, Landlords Tax Expenses Allocable to the Premises as hereinafter defined for a full Tax Year exceed Base Taxes Allocable to the Premises, or for any such fraction of a Tax Year exceed the corresponding fraction of Base Taxes Allocable to the Premises

Page 16

then, on or before the thirtieth (30th) day following receipt by Tenant of the certified statement referred to below in this Section 2.7, then Tenant shall pay to Landlord, as Additional Rent, the amount of such excess. In addition, payments by Tenant on account of increases in real estate taxes anticipated for the then current year shall be made monthly at the time and in the fashion herein provided for the payment of fixed rent. The amount so to be paid to Landlord shall be an amount reasonably estimated by Landlord to be sufficient to provide Landlord, in the aggregate, a sum equal to Tenants share of such increases, at least ten (10) days before the day on which such payments by Landlord would become delinquent. Not later than one hundred twenty (120) days after Landlords Tax Expenses Allocable to the Premises are determined for the first such Tax Year or fraction thereof and for each succeeding Tax Year or fraction thereof during the Term, Landlord shall render Tenant a statement in reasonable detail certified by a representative of Landlord showing for the preceding year or fraction thereof, as the case may be, real estate taxes on the Buildings and the Site and abatements and refunds of any taxes and assessments. Expenditures for reasonable legal fees (which may be on a contingency fee basis) and for other expenses incurred in seeking the tax refund or abatement may be charged against the tax refund or abatement before the adjustments are made for the Tax Year. Only Landlord shall have the right to institute tax reduction or other proceedings to reduce real estate taxes or the valuation of the Building and the Site. Said statement to be rendered to Tenant shall also show for the preceding Tax Year or fraction thereof as the case may be the amounts of real estate taxes already paid by Tenant as Additional Rent, and the amount of real estate taxes remaining due from, or overpaid by, Tenant for the year or other period covered by the statement. Within thirty (30) days after the date of delivery of the foregoing statement, Tenant shall pay to Landlord the balance of the amounts, if any, required to be paid pursuant to the above provisions of this Section 2.7 with respect to the preceding Tax Year or fraction thereof, or Landlord shall credit monthly installments of fixed rent next thereafter coming due (or refund such portion of the overpayment as aforesaid if the Term has ended and Tenant has no further obligation to Landlord).

To the extent that real estate taxes shall be payable to the taxing authority in installments with respect to periods less than a Tax Year, the foregoing statement shall be rendered and payments made on account of such installments.

Terms used herein are defined as follows:

(i) Tax Year means the twelve-month period beginning July 1 each year during the Term or if the appropriate governmental tax fiscal period shall begin on any date other than July 1, such other date. If during the Lease Term the Tax Year is changed by applicable law to less than a full 12-month period, the Base Taxes and Base Taxes Allocable to the Premises shall each be proportionately reduced.

(ii) Landlords Tax Expenses Allocable to the Premises shall mean (a) the same proportion of Landlords Tax Expenses for and pertaining to the Buildings as the Rentable Floor Area of the Premises bears to 95% of the Total Rentable Floor Area of the Buildings plus (b) the same proportion of Landlords Tax Expenses for and pertaining to the Site as the Rentable Floor Area of the Premises bears to 95% of the Total Rentable Floor Area of the Buildings.

Page 17

(iii) Landlords Tax Expenses with respect to any Tax Year means the aggregate real estate taxes on the Buildings and Site with respect to that Tax Year, reduced by any abatement receipts with respect to that Tax Year.

(iv) Base Taxes is hereinbefore defined in Section 1.1.

(v) Base Taxes Allocable to the Premises means (i) the same proportion of Base Taxes for and pertaining to the Buildings as the Rentable Floor Area of the Premises bears to 95% of the Total Rentable Floor Area of the Buildings, plus (ii) the same proportion of Base Taxes for and pertaining to the Site as the Rentable Floor Area of the Premises bears to 95% of the Total Rentable Floor Area of the Buildings.

(vi) Real estate taxes means all taxes and special assessments of every kind and nature assessed by any governmental authority (including, but not limited to, any tax, assessment or charge resulting from the creation of a special improvement district) on the Buildings or Site which Landlord shall become obligated to pay because of or in connection with the ownership, leasing and operation of the Complex, the Buildings and the Property and reasonable expenses of and fees for any formal or informal proceedings for negotiation or abatement of taxes (collectively, Abatement Expenses), which Abatement Expenses shall be excluded from Base Taxes. The amount of special taxes or special assessments to be included shall be limited to the amount of the installment (plus any interest, other than penalty interest, payable thereon) of such special tax or special assessment required to be paid during the year in respect of which such taxes are being determined. There shall be excluded from such taxes all income, estate, succession, inheritance and transfer taxes; provided, however, that if at any time during the Term the present system of ad valorem taxation of real property shall be changed so that in lieu of the whole or any part of the ad valorem tax on real property there shall be assessed on Landlord a capital levy or other tax on the gross rents received with respect to the Complex or Buildings or Property, federal, state, county, municipal, or other local income, estate, franchise, excise or similar tax, assessment, levy or charge (distinct from any now in effect in the jurisdiction in which the Property is located) measured by or based, in whole or in part, upon any such gross rents, then any and all of such taxes, assessments, levies or charges, to the extent so measured or based, shall be deemed to be included within the term real estate taxes but only to the extent that the same would be payable if the Site and Buildings were the only property of Landlord.

| 2.8 | Tenant Electricity |

Tenant shall pay to Landlord, as Additional Rent, Tenants Proportionate Share (hereinafter defined) of the cost incurred by Landlord in furnishing electricity and

Page 18

heating, ventilating and air conditioning (HVAC) to the Building and the Site, including common areas and facilities and space occupied by tenants, (but expressly excluding utility charges separately chargeable to tenants for additional or special services), and Tenant shall pay on account thereof, at the time that monthly installments of Annual Fixed Rent are due and payable, as Additional Rent, an amount equal to 1/12th (prorated for any partial month) of the amount estimated by Landlord from time to time as the Tenants Proportionate Share of the annual cost thereof. If with respect to any calendar year falling within the Term or fraction of a calendar year falling within the Term at the beginning or end thereof, the Tenants Proportionate Share of the cost of furnishing electricity and HVAC to the Building and the Site exceeds the amounts payable on account thereof, then Tenant shall pay to Landlord, as Additional Rent, on or before the thirtieth (30th) day following receipt by Tenant of the statement referred to below in this Section 2.8, Tenants Proportionate Share of the amount of such excess. For and with respect to the electricity and HVAC of the Building, the Tenants Proportionate Share shall be a fraction, the numerator of which is the Rentable Floor Area of the Premises and the denominator of which is the total rentable floor area of the Building from time to time under lease to tenants, and for and with respect to the electricity for the Site the Tenants Proportionate Share shall be a fraction, the numerator of which is the Rentable Floor Area of the Premises and the denominator of which is the total rentable floor area of the Buildings from time to time under lease to tenants. Also, in the event that there is located in the Premises a data center containing high density computing equipment, as defined in the U.S. EPAs Energy Star® rating system (Energy Star), Landlord may, at any time during the Term, require the installation in accordance with Energy Star of separate metering or check metering equipment (Tenant being responsible for the costs of any such meter or check meter and the installation and connectivity thereof). In the event that any other tenant in the Building installs a data center containing high density computing equipment or otherwise consumes electricity beyond normal office use, Landlord will require separate metering or check metering equipment for such other tenant. Notwithstanding the foregoing, with respect to any tenants existing in the Building as of the execution date of this Lease, Landlord shall only be obligated to require such separate metering or check metering equipment for such other tenant to the extent Landlord has the right to require such equipment under such other tenants lease. Tenant shall directly pay to the utility all electric consumption on any meter and shall pay to Landlord, as Additional Rent, all electric consumption on any check meter within thirty (30) days after being billed thereof by Landlord, in addition to other electric charges payable by Tenant under this Lease.

Not later than one hundred twenty (120) days after the end of the first calendar year or fraction thereof ending December 31 and of each succeeding calendar year during the Term or fraction thereof at the end of the Term, Landlord shall render Tenant a reasonably detailed accounting certified by a representative of Landlord showing for the preceding calendar year, or fraction thereof, as the case may be, the costs of furnishing electricity and HVAC to the Building and the Site. Said statement to be rendered to Tenant also shall show for the preceding year or fraction thereof, as the case may be, the amount already paid by Tenant on account of electricity and HVAC, and the amount remaining due from, or overpaid by, Tenant for the year or other period covered by the statement, and any underpayment shall be made, or overpayment credited (or refunded if the Term has ended and Tenant has no further obligation to Landlord) within thirty (30) days of delivering such statement.

Page 19

ARTICLE 3

Condition of Premises

| 3.1 | Preparation of Premises |

The condition of the Premises upon Landlords delivery along with any work to be performed by either Landlord or Tenant shall be as set forth in the Work Agreement attached hereto as Exhibit B-1 and made a part hereof.

ARTICLE 4

Landlords Covenants; Interruptions and Delays

| 4.1 | Landlord Covenants |

| 4.1.1 | Services Furnished by Landlord |

To furnish services, utilities, facilities and supplies set forth in Exhibit C equal to those customarily provided by landlords in high quality buildings in the Boston West Suburban Market subject to escalation reimbursement in accordance with Section 2.6 (except as may otherwise be expressly provided in said Exhibit C).

| 4.1.2 | Additional Services Available to Tenant |

To furnish, at Tenants expense, reasonable additional Building operation services which are usual and customary in similar office buildings in the Boston West Suburban Market upon reasonable advance request of Tenant at reasonable and equitable rates from time to time established by Landlord.

| 4.1.3 | Roof, Exterior Wall, Floor Slab and Common Facility Repairs |

Subject to the escalation provisions of Section 2.6 and except as otherwise provided in Article VI, (i) to make such repairs to the roof, exterior walls, floor slabs, and all heating, ventilating and air conditioning equipment, all plumbing, wiring and other mechanical systems serving the Common Areas or serving the Premises in common with others, and common areas and facilities as may be necessary to keep them in good working condition and (ii) to maintain the Building and the Site (exclusive of Tenants responsibilities under this Lease) in a first class manner comparable to the maintenance of similar properties in the Boston West Suburban Market.

Page 20

| 4.1.4 | Signs |

(A) To provide and install, at Landlords expense for the initial installation (all changes thereafter at Tenants expense), (i) letters or numerals on exterior doors in the Premises to identify Tenants name and Building address; all such letters and numerals shall be in the building standard graphics and no others shall be used or permitted at the entrance of the Premises and (ii) Tenants name on the Buildings lobby directory (if any).

(B) For so long as (i) Tenant has neither assigned this Lease nor sublet more than thirty percent (30%) of the Rentable Floor Area of the Premises (in either case except for (x) an assignment or subletting permitted without Landlords consent under Section 5.6.4 hereof, or (y) occupancy of part of the Premises by one or more Licensee Parties, as defined in Section 5.6.4 hereof) (the Occupancy Signage Condition) and (ii) there exists no monetary Event of Default (defined in Section 7.1) (the Default Signage Condition and, together with the Occupancy Signage Condition, the Signage Conditions), Tenant shall be permitted, at Tenants sole cost and expense, to erect an exterior sign (the Façade Sign) on the upper right portion of the façade of the Building facing Route 95/Route 128 containing Tenants name and logo in the location substantially as shown on Exhibit I-1 attached hereto. The design, materials, proportions, method of installation, and color of the Façade Sign shall be subject to the prior approval of Landlord, which approval shall not be unreasonably withheld, conditioned or delayed so long as such attributes of Tenants proposed Façade Sign are reasonably consistent with the corresponding attributes of the existing Constant Contact sign installed on the façade of the Building. In addition, the Façade Sign shall be subject to (a) the requirements of the Zoning By-Law of the City of Waltham and any other applicable laws and (b) Tenant obtaining all necessary permits and approvals therefor. Any electricity required in connection with the Façade Sign shall be at Tenants sole cost and expense. Tenant acknowledges and agrees that Tenants right to corporate signage on the Building pursuant to this Section is not on an exclusive basis and that Landlord may grant others the right to signage elsewhere on the Building; provided, however, that until the earlier to occur of (i) September 30, 2022 and (ii) the date on which there is a failure of any of the Signage Conditions, Landlord shall not permit any other tenant of the Building to erect a sign on the portion of the façade of the Building shown as the cross-hatched area on Exhibit I-2 attached hereto. The installation, replacement, removal and restoration after removal of the Façade Sign shall be performed at Tenants sole cost and expense in accordance with the provisions of this Lease applicable to alterations (including, without limitation, Section 5.12 hereof). Notwithstanding the foregoing, (i) within thirty (30) days after the date on which there occurs a failure of any of the Signage Conditions and Landlord notifies (the Removal Notice) Tenant to remove the Façade Sign or (ii) immediately upon the expiration or earlier termination of the Term of the Lease, Tenant shall, at Tenants cost and expense, remove the Façade Sign and restore all damage to the Building caused by the installation and/or removal of the Façade Sign; provided, however, that in the case of a failure of the Default Signage Condition, Tenant shall not be required to remove the Façade Sign if

Page 21

Tenant cures the applicable monetary Event of Default within five (5) business days after receipt of the Removal Notice and Landlord accepts such cure. The right to the Façade Sign granted pursuant to this Section 4.1.4(B) is personal to Tenant, and may not be exercised by any occupant, subtenant, or other assignee of Tenant, other than a Permitted Transferee that, in Landlords sole discretion, has a character consistent with first-class office buildings in the Boston West Suburban market.

| 4.2 | Interruptions and Delays in Services and Repairs, Etc. |

Landlord shall not be liable to Tenant for any compensation or reduction of rent by reason of inconvenience or annoyance or for loss of business arising from the necessity of Landlord or its agents entering the Premises for any of the purposes in this Lease authorized, or for repairing the Premises or any portion of the Building or Site however the necessity may occur. In case Landlord is prevented or delayed from making any repairs, alterations or improvements, or furnishing any services or performing any other covenant or duty to be performed on Landlords part, by reason of any cause reasonably beyond Landlords control, including without limitation by reason of Force Majeure (as defined in Section 6.1 hereof) Landlord shall not be liable to Tenant therefor, nor, except as expressly otherwise provided in Article VI, shall Tenant be entitled to any abatement or reduction of rent by reason thereof, or right to terminate this Lease, nor shall the same give rise to a claim in Tenants favor that such failure constitutes actual or constructive, total or partial, eviction from the Premises.

Notwithstanding anything to the contrary in this Lease contained, if the Premises shall lack any service which Landlord is required to provide hereunder (thereby rendering the Premises or a portion thereof untenantable) (a Service Interruption) so that, for the Landlord Service Interruption Cure Period, as hereinafter defined, the continued operation in the ordinary course of Tenants business is materially adversely affected and if Tenant ceases to use the affected portion of the Premises during the period of untenantability as the direct result of such lack of service, then, provided that Tenant ceases to use the affected portion of the Premises during the entirety of the Landlord Service Interruption Cure Period and that such untenantability and Landlords inability to cure such condition is not caused by the fault or neglect of Tenant or Tenants agents, employees or contractors, Annual Fixed Rent and Additional Rent shall thereafter be abated in proportion to such untenantability until such condition is cured sufficiently to allow Tenant to occupy the affected portion of the Premises.

For the purposes hereof, the Landlord Service Interruption Cure Period shall be defined as five (5) consecutive business days after Landlords receipt of written notice from Tenant of the condition causing untenantability in the Premises, provided however, that the Landlord Service Interruption Cure Period shall be ten (10) consecutive business days after Landlords receipt of written notice from Tenant of such condition causing untenantability in the Premises if either the condition was caused by causes beyond Landlords control or Landlord is unable to cure such condition as the result of causes beyond Landlords control.

Page 22

The provisions of Section 4.2 shall not apply in the event of untenantability caused by fire or other casualty, or taking (see Article 6). The remedies set forth in this Section 4.2 shall be Tenants sole remedies in the event of a Service Interruption.

Without limiting Tenants rights in the case of a Service Interruption, Landlord reserves the right to stop any service or utility system, when necessary by reason of accident or emergency, or until necessary repairs have been completed; provided, however, that in each instance of stoppage, Landlord shall exercise reasonable diligence to eliminate the cause thereof. Except in case of emergency repairs, Landlord will give Tenant reasonable advance notice of any contemplated stoppage and will use reasonable efforts to avoid unnecessary inconvenience to Tenant by reason thereof.

So long as Tenant shall comply with Landlords reasonable security program for the Building, Tenant shall have access to the Premises and for monthly pass holders the Garage twenty-four (24) hours per day during the Term of this Lease, except in an emergency or in the case of Force Majeure.

| 4.3 | Payment of Litigation Expenses. |

Tenant shall not be obligated to make any payment to Landlord of any attorneys fees incurred by Landlord unless judgment is entered (final, and beyond appeal) in favor of Landlord in the lawsuit relating to such fees. Landlord shall pay, upon demand by Tenant, reasonable attorneys fees incurred by Tenant in connection with any lawsuit between Landlord and Tenant where judgment is entered (final, and beyond appeal) in favor of Tenant.

ARTICLE 5

Tenants Covenants

Tenant covenants and agrees to the following during the term and such further time as Tenant occupies any part of the Premises:

| 5.1 | Payments |

To pay when due all fixed rent and Additional Rent and all charges for utility services rendered to the Premises (except as otherwise provided in Exhibit C) and, as further Additional Rent, all charges for additional services rendered pursuant to Section 4.1.2. In the event Tenant pays any utilities for the Premises directly to the utility company or provider, Tenant shall, upon Landlords written request, provide Landlord with copies of such bills to the extent in Tenants possession.

| 5.2 | Repair and Yield Up |

Except as otherwise provided in Article VI and Section 4.1.3 to keep the Premises in good order, repair and condition, including all glass in windows (except glass in exterior walls unless the damage thereto is attributable to Tenants negligence or misuse) and

Page 23

doors of the Premises whole and in good condition with glass of the same type and quality as that injured or broken, reasonable wear and tear and damage by fire or taking under the power of eminent domain only excepted, and at the expiration or termination of this Lease peaceably to yield up the Premises all construction, work, improvements, and all alterations and additions thereto in good order, repair and condition, reasonable wear and tear and damage by fire or other casualty only excepted, first removing (i) all goods and effects of Tenant, (ii) the wiring for Tenants computer, telephone and other communication systems and equipment whether located in the Premises or in any other portion of the Building, including all risers, unless Landlord, by notice to Tenant given at least ten (10) business days before such expiration or termination, specifies that such wiring need not be removed, and (iii) all Required Removables (as hereafter defined), and repairing any damage caused by such removal and restoring the Premises and leaving them clean and neat. As used herein, Required Removables shall mean any alterations or additions which (x) are of a type not shown on the Approved Schematic Plan (as defined in Exhibit B-1) (the type of work shown on the Approved Schematic Plan being hereinafter referred to as Standard Office Improvements), and (y) as to which Landlord indicates, at the time it approves the plans therefor, that Tenant will be required to remove the same at the expiration or earlier termination of the Term of this Lease. Landlord agrees that nothing shown on the Approved Schematic Plan will constitute a Required Removable. Tenant shall not permit or commit any waste, and Tenant shall be responsible for the cost of repairs which may be made necessary by reason of damage to common areas in the Building, to the Site or to the Additional Building caused by Tenant, Tenants agents, employees, contractors, sublessees, licensees, concessionaires or invitees. Tenant shall maintain all its equipment, furniture and furnishings in good order and repair, reasonable wear and tear excepted.

| 5.3 | Use |

To use and occupy the Premises for the Permitted Uses only, and not to injure or deface the Premises, Building, the Additional Building, the Site or any other part of the Complex nor to permit in the Premises or on the Site any auction sale, more than four (4) vending machines, or inflammable fluids or chemicals, or nuisance, or the emission from the Premises of any objectionable noise or odor, nor to permit in the Premises anything which would in any way result in the leakage of fluid or the growth of mold, nor to use or devote the Premises or any part thereof for any purpose other than the Permitted Uses, nor any use thereof which is inconsistent with the maintenance of the Building as an office building of the first class in the quality of its maintenance, use and occupancy, or which is improper, offensive, contrary to law or ordinance or liable to invalidate or increase the premiums for any insurance on the Building or its contents or liable to render necessary any alteration or addition to the Building. Without limiting the generality of the foregoing, Tenant agrees that it shall not use the Premises or any part thereof, or permit the Premises or any part thereof to be used for the preparation or dispensing of food, except that Tenant may, with Landlords prior written consent (including approval of plans for any such equipment that has a water connection), which consent shall not be unreasonably withheld, install at its own cost and expense so-called hot-cold water fountains, coffee makers, microwave ovens, refrigerators and commonly used kitchen or

Page 24

pantry equipment (excluding, however, stovetops, hot plates, ovens or toaster ovens; however, toaster ovens with an auto-shutoff feature shall be permitted) for the preparation of beverages and foods, provided that no cooking, frying, etc., are carried on in the Premises to such extent as requires special exhaust venting. Landlord hereby agrees that any equipment shown on Tenants final approved plans and equivalent equipment in substitution of such equipment shall not, if installed in accordance with such plans and maintained in good operating order, be deemed to violate the provisions of this Section 5.3. Further, (i) Tenant shall not, nor shall Tenant permit its employees, invitees, agents, independent contractors, contractors, assignees or subtenants to, keep, maintain, store or dispose of (into the sewage or waste disposal system or otherwise) or engage in any activity which might produce or generate any substance which is or may hereafter be classified as a hazardous material, waste or substance (collectively Hazardous Materials), under federal, state or local laws, rules and regulations, including, without limitation, 42 U.S.C. Section 6901 et seq., 42 U.S.C. Section 9601 et seq., 42 U.S.C. Section 2601 et seq., 49 U.S.C. Section 1802 et seq. and Massachusetts General Laws, Chapter 21E and the rules and regulations promulgated under any of the foregoing, as such laws, rules and regulations may be amended from time to time (collectively Hazardous Materials Laws), (ii) Tenant shall immediately notify Landlord of any incident in, on or about the Premises, the Building or the Site of which it has knowledge that would require the filing of a notice under any Hazardous Materials Laws, (iii) Tenant shall comply and shall cause its employees, invitees, agents, independent contractors, contractors, assignees and subtenants to comply with each of the foregoing and (iv) Landlord shall have the right, at Landlords cost (except if a violation is found), to make such inspections (including testing) as Landlord shall elect from time to time to determine that Tenant is complying with the foregoing.

Notwithstanding anything contained in this Lease to the contrary, Tenant shall have no obligation to remove any Hazardous Materials existing in the Premises prior to the Delivery Date, and Landlord shall be solely responsible for the costs of removal of the same in accordance with applicable law.

| 5.4 | Obstructions; Items Visible From Exterior; Rules and Regulations |

Not to obstruct in any manner any portion of the Building not hereby leased or any portion thereof or of the Additional Building or of the Site used by Tenant in common with others; not without prior consent of Landlord to permit the painting or placing of any signs, curtains, blinds, shades (provided that Landlord will, at Landlords sole cost and expense, install frosting on the windows of the Premises facing the atrium of the Building in accordance with a window frosting standard to be mutually agreed upon by Landlord and Tenant), awnings, aerials or flagpoles, or the like, visible from outside the Premises except in compliance with any rules and regulations or customer handbook for the Building; and to comply with all reasonable rules and regulations or the requirements of any customer handbook currently in existence or hereafter implemented, of which Tenant has been given notice, for the care and use of the Building and Site and their facilities and approaches; Landlord shall not be liable to Tenant for the failure of other occupants of the Buildings to conform to such rules and regulations. Notwithstanding anything to the contrary in this Lease contained, Landlord agrees that it will not enforce

Page 25

said rules and regulations against Tenant in a discriminatory or arbitrary manner (recognizing that differing circumstances may justify different treatment). If and to the extent there is any conflict between the provisions of this Lease and any rules and regulations or customer handbook for the Building, the provisions of this Lease shall control.

| 5.5 | Safety Appliances; Licenses |

To keep the Premises equipped with all safety appliances required by any public authority because of any use made by Tenant other than normal office use, and to procure all licenses and permits so required because of such use and, if requested by Landlord, to do any work so required because of such use, it being understood that the foregoing provisions shall not be construed to broaden in any way Tenants Permitted Use.

| 5.6 | Assignment; Sublease |

| 5.6.1 | Except as otherwise expressly provided herein, Tenant covenants and agrees that it shall not assign, mortgage, pledge, hypothecate or otherwise transfer this Lease and/or Tenants interest in this Lease or sublet (which term, without limitation, shall include granting of concessions, licenses or the like) the whole or any part of the Premises. If and so long as Tenant is a Close Corporation, as hereinafter defined, or a limited liability company or a partnership, an assignment, within the meaning of this Section 5.6, shall be deemed to include one or more sales or transfers of stock or membership or partnership interests, by operation of law or otherwise, or the issuance of new stock or membership or partnership interests, by which an aggregate of more than fifty percent (50%) of Tenants stock or membership or partnership interests shall be vested in a party or parties who are not stockholders or members or partners as of the date hereof (a Majority Interest Transfer). As used herein, a Close Corporation shall mean a corporation that (w) is not traded on a public stock exchange, or that (x) has fewer than five hundred (500) shareholders. For the purpose of this Section 5.6, ownership of stock or membership or partnership interests shall be determined in accordance with the principles set forth in Section 544 of the Internal Revenue Code of 1986, as amended from time to time, or the corresponding provisions of any subsequent law. In addition, the following shall be deemed an assignment within the meaning of this Section 5.6: (a) the merger or consolidation of Tenant into or with any other entity, or the sale of all or substantially all of its assets, and (b) the establishment by Tenant or a permitted successor or assignee of one or more series of series of (1) members, managers, limited liability company interests or assets, which may have separate rights, powers or duties with respect to specified property or obligations of Tenant (or such successor or assignee) or profits or losses associated with specified property or obligations of Tenant (or such successor or assignee), pursuant to §18-215 of the Delaware Limited Liability Company Act, as amended, or similar laws of other states or otherwise, or (2) limited partners, general partners, partnership interests or assets, which may have separate rights, powers or duties with respect to specified property or obligations of Tenant (or such successor or assignee) or profits or losses |

Page 26

| associated with specified property or obligations of Tenant (or such successor or assignee) pursuant to §17-218 of the Delaware Revised Uniform Limited Partnership Act, as amended, or similar laws of other states or otherwise (a Series Reorganization). Any assignment, mortgage, pledge, hypothecation, transfer or subletting not expressly permitted in or consented to by Landlord under this Section 5.6 shall, at Landlords election, be void; shall be of no force and effect; and shall confer no rights on or in favor of third parties. In addition, Landlord shall be entitled to seek specific performance of or other equitable relief with respect to the provisions hereof. The limitations of this Section 5.6 shall be deemed to apply to any guarantor(s) of this Lease. |

| 5.6.2 | Recapture. |

| (A) | Notwithstanding the provisions of Section 5.6.1 above, in the event Tenant desires (i) to assign this Lease or (ii) to enter into a Triggering Sublease, as hereinafter defined (in either case other than a proposed assignment or subletting pursuant to Section 5.6.4. below), then Tenant shall give Landlord a written notice (the Recapture Notice). As used herein, a Triggering Sublease shall mean a sublease of fifty percent (50%) or more of the Premises for ninety percent (90%) or more of the remainder of the Term hereof (excluding any unexercised option periods). The Recapture Notice shall specify that Tenant desires to enter into a Triggering Sublease, or to assign its interest in this Lease, other than pursuant to Section 5.6.4. below. The Recapture Notice shall state the affected portion of the Premises (Recapture Premises), and shall constitute an offer (Recapture Offer) to terminate this Lease with respect to the Recapture Premises. |

| (B) | Landlord shall have thirty (30) days (the Acceptance Period) to deliver written notice to Tenant (Acceptance Notice) accepting Tenants Recapture Notice. If Landlord does not timely deliver an Acceptance Notice, it shall be deemed to have declined Tenants Recapture Offer. |

| (C) | Landlords Acceptance Notice shall specify a termination date (Recapture Termination Date), which date shall not be earlier than sixty (60) days nor later than one hundred and twenty (120) days after the date of Landlords Acceptance Notice. Upon the Recapture Termination Date, all obligations with respect to the Recapture Premises relating to the period after the Recapture Termination Date (but not those relating to the period before the Recapture Termination Date) shall cease and promptly upon being billed therefor by Landlord, Tenant shall make final payment of all Annual Fixed Rent and Additional Rent due from Tenant through the Recapture Termination Date, and Tenant shall have no liability for any obligation with respect to the Recapture Premises accruing after the Recapture Termination Date. If Landlord exercises such right to terminate the Lease, then, Landlord may lease the Premises to any party of a character consistent with first class office buildings in the Boston West Suburban market. |

Page 27

| (D) | Notwithstanding the provisions of Section 5.6.1 above, but subject to the provisions of this Section 5.6.3 and the provisions of Sections 5.6.5 and 5.6.6 below, in the event that Landlord shall not have exercised the termination right as set forth in Section 5.6.2, or shall have failed to give any or timely notice under Section 5.6.2, then for a period of one hundred thirty-five (135) days (i) after the receipt of Landlords notice stating that Landlord does not elect the termination right, or (ii) after the expiration of the Acceptance Period, in the event Landlord shall not give any or timely notice under Section 5.6.2 as the case may be, Tenant shall have the right to assign this Lease or sublet the whole or any portion of the Premises in accordance with the remaining provisions of this Section 5.6. |

| 5.6.3 | Proposed Transfer Notice; Landlord Consent. |

| (A) | In the case where (i) a Recapture Offer has been made, and Landlord declines (or is deemed to have declined) such Recapture Offer, or (ii) no Recapture Offer is required pursuant to Section 5.6.2, then Tenant shall, prior to entering into any assignment or sublease, give Landlord written notice (the Proposed Transfer Notice) of any proposed sublease or assignment. The Proposed Transfer Notice shall specify the provisions of the proposed assignment or subletting, including (a) the name and address of the proposed assignee or subtenant, (b) in the case of a proposed assignment or subletting pursuant to Section 5.6.3 below, such information as to the proposed assignees or proposed subtenants net worth and financial capability and standing as may reasonably be required for Landlord to make the determination referred to in said Section 5.6.3 (provided, however, that Landlord shall hold such information confidential having the right to release same to its officers, accountants, attorneys and mortgage lenders on a confidential basis), (c) the material terms and provisions upon which the proposed assignment or subletting is to be made, and (d) in the case of a proposed assignment or subletting pursuant to Section 5.6.3 below, all other information necessary to make the determination referred to in said Section 5.6.3. Any proposed sublease or assignment described in a Proposed Transfer Notice shall be subject to Landlords prior written approval, which shall not be unreasonably withheld. Landlord shall respond to a Proposed Transfer Notice within fifteen (15) business days. In no event shall Tenant advertise the Premises for sublease or assignment at a rent that is less than the market rent and other charges for first class office space for properties of a similar character in the Boston West Suburban market. |

Page 28

| (B) | Without limiting the foregoing standard, Landlord shall not be deemed to be unreasonably withholding its consent to such a proposed assignment or subleasing if: |